10 Important Mortgage Tips For First Time Home Buyers

Important mortgage tips

You’re just starting your search to purchase a Portland Metro Area home-this is an exciting time! Before you schedule your first home tour, getting prequalified for a mortgage is an important first step. Here’s a checklist to get you on your way to buying the Portland home of your dreams.

Personal documents:

You’ll need two forms of government-issued ID, your social security number, divorce papers if applicable, as well as proof of ownership of other property.

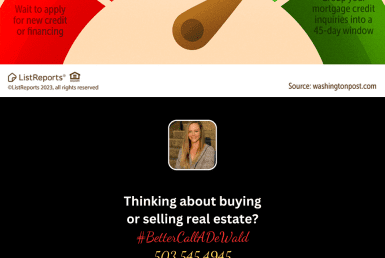

Review your credit report:

You should be able to do this free of charge. Be sure to dispute any errors or provide an explanation for late payments or derogatory items. Then, keep your credit score healthy by avoiding any new credit inquiries, canceling any credit accounts, or lowering limits with any creditors. Doing any of these things could lower your credit score.

Tax returns:

You’ll need to provide tax returns for the previous year, and potentially for the last two years.

Proof of income:

Gather W2s, paycheck stubs, 1099s, or a year-to-date profit and loss statement if you’re self-employed. You’ll also need to show other income sources such as Social Security, child support (and proof children’s ages), or government assistance.

Proof of assets:

Provide bank statements, mutual fund statements, account balances for retirement accounts, 401Ks, IRAs, and any money held in the stock market.

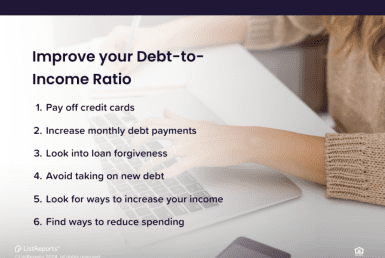

Debt summary:

You’ll need to provide a summary of your debts, monthly payment amounts, child support payments and balances for credit cards, student loans, car loans, other property loans.

Financial issues:

You may need to provide a written explanation if you’ve had bankruptcy or other financial issues in the past.

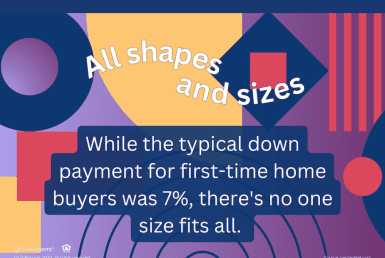

Down payment and closing money ready:

Have these funds ready in your bank account. If you received this money as a gift, you might need to provide a letter from the gifter explaining the gift is not a loan.

- Renting? Compile proof for the past year with canceled checks or money orders to show rent was paid on time.

- Mortgage pre-approval successful? Do some comparison shopping and contact other lenders. A home is likely the largest purchase you’ll ever make, do your homework to ensure you get a competitive deal.

Applying for your first mortgage? Get in touch with your local Portland realty agent! I’d be happy to walk you through the process.

Start Investing With Your First Home – JD PDX Real Estate

July 3, 2018 at 10:22 pm

[…] 10 Important Mortgage Tips For First Time Home Buyers […]