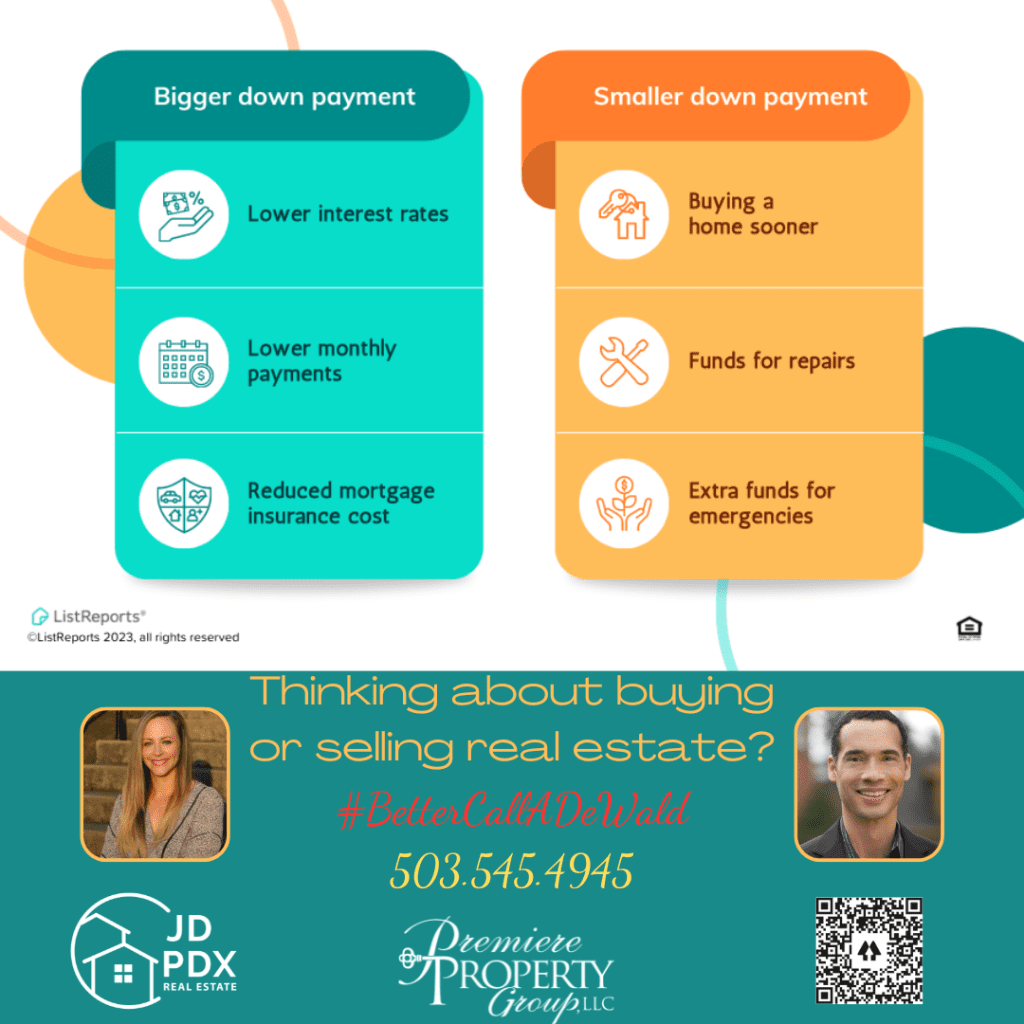

Advantages of Bigger or Lower Downpayment

-

by Jamohl DeWald

by Jamohl DeWald

- July 25, 2023

- Buying Real Estate, First Time Homebuyer

- 0

Some buyers believe a bigger down payment is better, while others would rather put the minimum down possible. If you’d like to discuss which option is best for you, feel free to send us a message so we can evaluate the pros and cons together! Below we discuss advantages of bigger or lower downpayment.

#BetterCallADeWald 503.545.4945

The advantages of a bigger or lower down payment depend on the individual’s financial situation and goals. Here are some benefits of each:

Advantages of a Bigger Down Payment:

- Lower Monthly Payments: A larger down payment reduces the principal amount borrowed, resulting in lower monthly mortgage or loan payments. This can free up more of your monthly budget for other expenses or investments.

- Reduced Interest Costs: With a smaller loan amount, you’ll pay less interest over the life of the loan, potentially saving thousands of dollars in interest payments.

- Lower Risk for Lenders: A substantial down payment lowers the lender’s risk, making you a more attractive borrower. This may lead to better interest rates and loan terms.

- Easier Loan Approval: A larger down payment can improve your chances of getting approved for a loan, especially if your credit score is not perfect or you have a higher debt-to-income ratio.

- No Private Mortgage Insurance (PMI): If you put down 20% or more on a conventional mortgage, you typically avoid having to pay PMI, which is an additional monthly cost that protects the lender if you default on the loan.

Advantages of a Lower Down Payment:

- Preserve Cash Flow: Opting for a lower down payment allows you to keep more cash on hand for emergencies, investments, or other financial goals.

- Faster Homeownership: For first-time homebuyers or those with limited savings, a lower down payment can make homeownership more attainable, allowing them to enter the market sooner.

- Investment Opportunities: By keeping more money available, you have the potential to invest in other assets or opportunities that could yield higher returns than tying up funds in a larger down payment.

- Flexibility: A lower down payment means you have more financial flexibility, which can be especially helpful in uncertain economic times.

- Tax Benefits: Depending on your country’s tax laws, mortgage interest and certain loan costs may be tax-deductible, so a smaller down payment could provide greater tax benefits.

Both options have their merits, so it’s important to choose what aligns best with your unique circumstances and objectives.

#realestate #realestateagent #JDPDXRealEstate #homeowner #homeownership #homebuying #buyingahome #downpayment