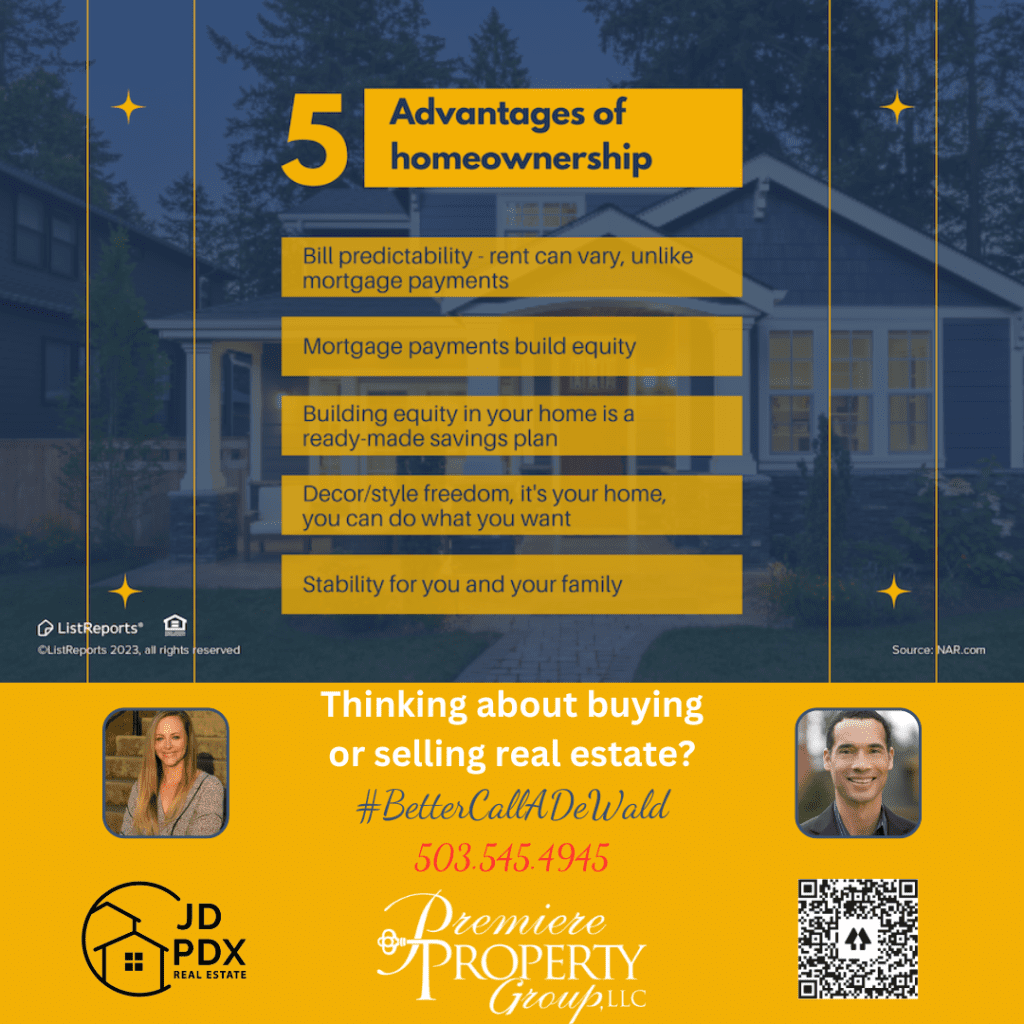

Advantages of Homeownership

-

by Jamohl DeWald

by Jamohl DeWald

- May 22, 2023

- Buying Real Estate, Real Estate, Real Estate Investment

- 0

Changing your status from “renter” to “owner” can be intimidating, but it has many long-term and short-term benefits. And at the end of the day, it is so nice to come home to a place that’s yours. If you’re going to pay a mortgage, it may as well be your own!

#BetterCallADeWald 503.545.4945

Homeownership offers several advantages that make it an attractive option for many individuals and families. Here are some key benefits of homeownership:

- Equity and Investment: Purchasing a home allows you to build equity over time. As you make mortgage payments, you gradually increase your ownership stake in the property. Unlike renting, homeownership offers the potential for long-term financial growth as the value of the property appreciates.

- Stability and Control: Owning a home provides stability and control over your living environment. You have the freedom to customize and personalize your space, whether it’s through renovations, landscaping, or interior design. Additionally, homeownership provides a sense of belonging and community, as you establish roots in a neighborhood.

- Tax Benefits: Homeowners can take advantage of various tax benefits. Mortgage interest and property tax payments are typically tax-deductible, which can help reduce your overall tax burden. These deductions can result in significant savings, especially in the early years of homeownership when interest payments are higher.

- Potential Rental Income: Homeownership offers the possibility of generating rental income. If you have additional space or decide to move, you can rent out your property and earn regular rental payments, providing an additional source of income.

- Long-Term Financial Security: Homeownership is often seen as a long-term investment that can provide financial security during retirement. Once your mortgage is paid off, you eliminate the monthly housing expense, which can significantly reduce your overall living costs.

- Building Credit and Borrowing Power: Consistently making mortgage payments on time and managing your home-related finances responsibly can help you establish and improve your credit score. A good credit history and the equity you’ve built can enhance your borrowing power for future loans or credit lines.

- Sense of Pride and Accomplishment: Owning a home can bring a sense of pride and accomplishment. It represents a milestone in life and a symbol of success and stability.

It’s important to note that homeownership also comes with responsibilities, such as maintenance costs and potential market fluctuations. Consider your financial situation, personal goals, and lifestyle before making the decision to become a homeowner.

#JDPDXRealEstate #homebuyer #homeowner #realestate #realtor #realestateagent

Join The Discussion