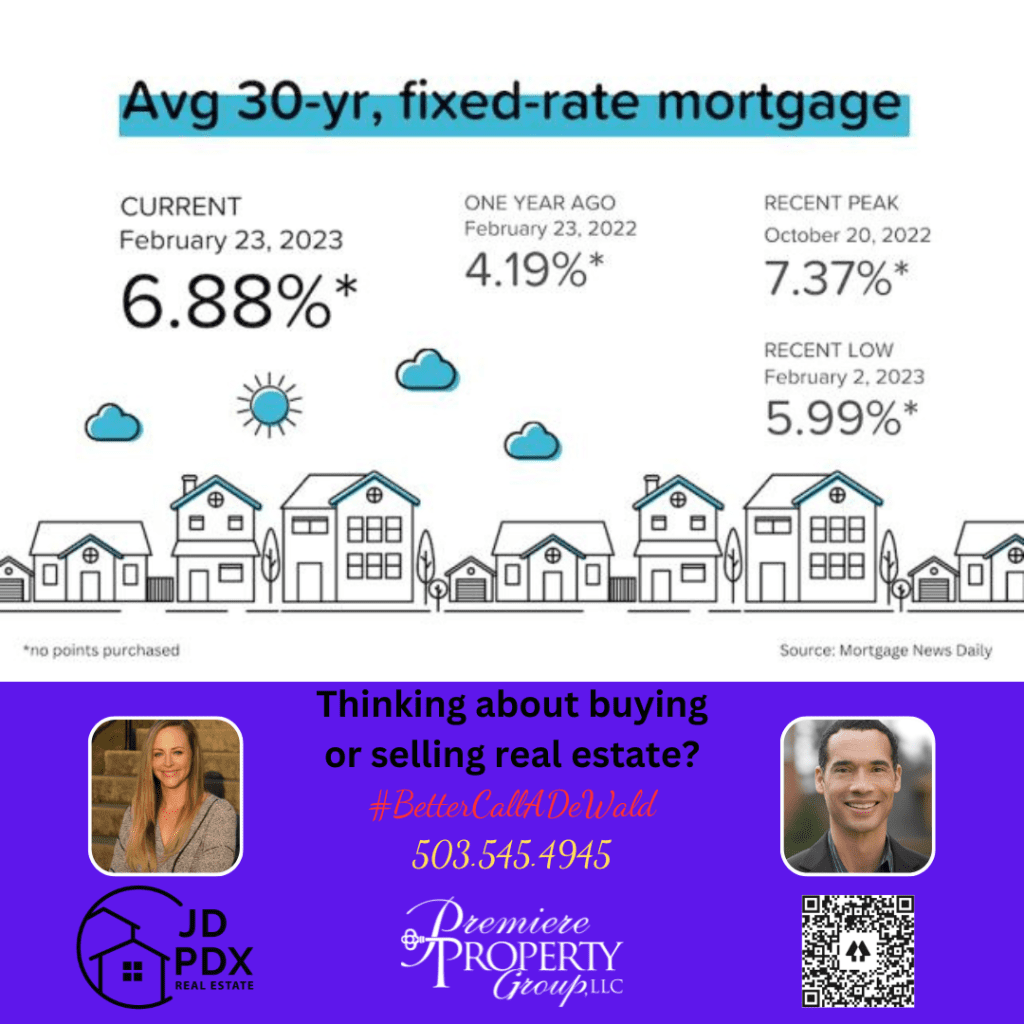

Avg 30 Year Fixed Rate Mortgage

-

by Jamohl DeWald

by Jamohl DeWald

- February 25, 2023

- Buying Real Estate, Mortgage, Real Estate

- 0

February has not been kind to would-be homebuyers. In less than a month, the average 30 year fixed rate mortgage has leapt from just below 6% to nearly 7%. Roughly two-thirds of the mortgage rate improvement we’ve seen since late October 2022 vanished in a few weeks. For all your real estate needs….

#BetterCallADeWald 503.545.4945

Mortgage rates are affected by a variety of factors, including:

- The economy: Mortgage rates are influenced by the health of the economy, including inflation, economic growth, and employment levels.

- The Federal Reserve: The Federal Reserve sets monetary policy, including the federal funds rate, which can influence mortgage rates.

- Bond market: Mortgage rates are often tied to the bond market, particularly the yield on the 10-year Treasury note.

- Credit score: A borrower’s credit score is an important factor in determining their mortgage rate. Higher credit scores generally lead to lower mortgage rates.

- Loan amount and down payment: Larger loan amounts and smaller down payments often result in higher mortgage rates.

- Type of loan: Different types of loans, such as fixed-rate or adjustable-rate mortgages, can have different interest rates.

- Location: Mortgage rates can vary based on the location of the property, including the state and county.

Overall, the average 30 year fixed rate mortgage is influenced by a complex set of factors, and can vary over time and based on individual circumstances.

Join The Discussion