Avoid the Biggest First Time Homebuyer Mistakes

Homebuyer

It’s all too easy for a first time homebuyer to make missteps during the buying process. After all, there are a lot of moving pieces to consider; not to mention all the online resources offering advice (some of which is contradictory-Zillow)! So let’s cut through the noise and highlight some of the biggest first time homebuyer pitfalls that you should avoid in Portland Metro Area.

Not knowing what you can afford

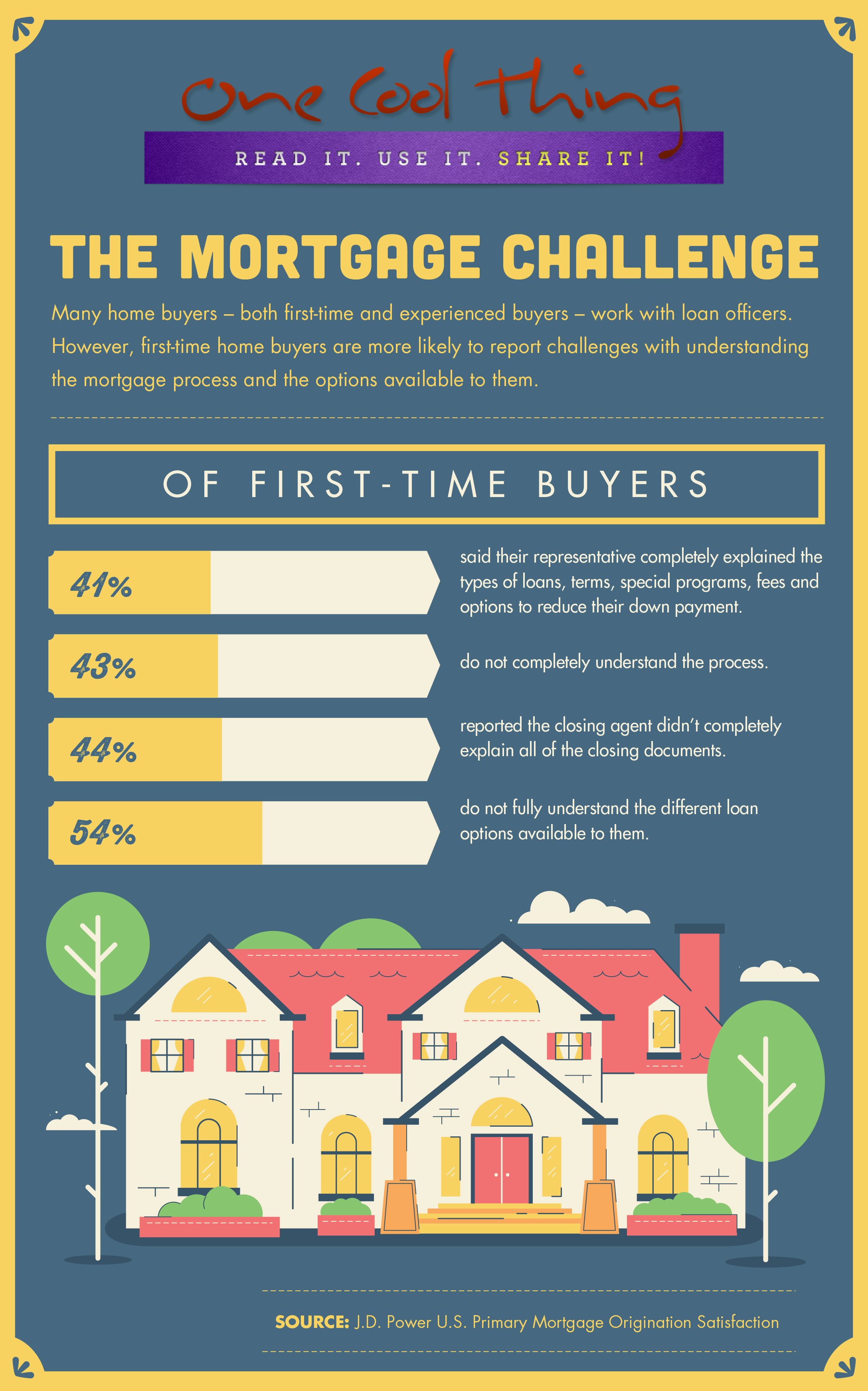

Many first-time homebuyers get caught up in researching the “exciting” aspects of the homebuying process – things like kitchen amenities, floor plans, and the square footage of backyards. While these things are certainly important, as a first time homebuyer you need to make sure you dedicate time to researching financing options. Talk to a qualified lender and get yourself pre-approved for a mortgage. If you don’t do this first, you might end up falling in love with a Beaverton home that you can’t afford. Will you have to carry mortgage insurance, are there monthly HOA fees involved, what are your closing costs going to be, how much will inspections & needed repairs cost, etc. These are all things you will want to plan and budget for.

Picking the wrong neighborhood

As mentioned above, first time home buyers often get caught up in details that pertain to the actual, physical homes they’re looking at. Equally important, however, is where a home is located. If you’re a young, active couple that’s prone to throwing parties, a quiet Beaverton neighborhood made up primarily of older residents probably isn’t the place for you. First time home buyers that plan to start a family may also want to make sure they are moving to a neighborhood with highly rated schools.

When looking at homes, make sure to pay attention to neighborhoods. Ask yourself, “Where’s the nearest grocery store?”, “Are there lots of people jogging and walking pets?,” and so on. By picking a neighborhood that’s tailored to your lifestyle, you’ll have a much more enjoyable home-owning experience after you buy.

Not calculating expenses

You did it! You found the perfect house in the perfect neighborhood and – best of all – it’s in your price range…or is it? There are many additional expenses associated with owning a home that first time buyers often overlook. These include Portland Metro Area property taxes, maintenance work, and utility bills. So before you pull the trigger on a home, make sure you figure out what such expenses will run you ahead of time.

Join The Discussion