Big Financial No Nos

Buying a home? Keep your finances steady for a smoother closing process. Big changes like moving money around or switching jobs can cause bumps along the way. Trust us—you want a stress-free path to your dream home!

#BetterCallJamohl 503.545.4945

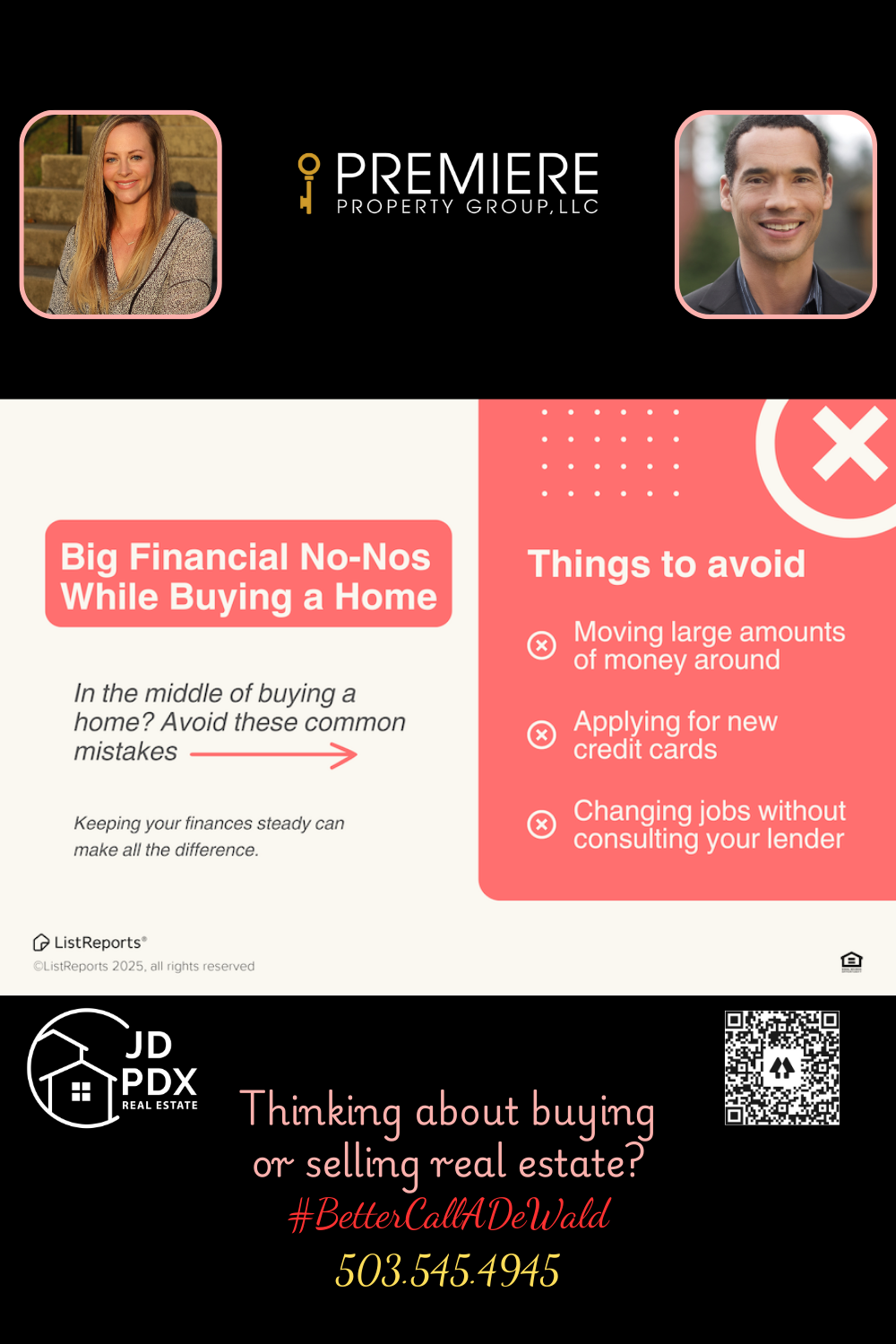

Big Financial No-Nos When Buying a Home

Buying a home is a huge milestone—and keeping your finances steady during the process is key to making it a smooth one. While it’s tempting to move money around or open a new credit card before the big move, doing so could create unexpected roadblocks and slow down your path to homeownership.

Some of the biggest financial no-nos while buying a home include:

- Moving large amounts of money between accounts

- Applying for new credit cards or loans

- Changing jobs without talking to your lender first

Even if these seem harmless, they can trigger red flags for lenders, affect your credit score, or delay your loan approval. And trust us—you don’t want last-minute surprises standing between you and your new home.

That’s why we always recommend keeping things financially “boring” while you’re in escrow. If you’re ever unsure, we’re just a message away and can connect you with trusted lenders who can walk you through what to do—and what not to do.

Let’s keep your path to homeownership stress-free and successful. Reach out with any questions—we’ve got you every step of the way! #HomeBuyingTips #RealEstateAdvice #FinancialTips

#homebuyer #JDPDXRealEstate #realestate #realtor #realestateagent #investment #dreamhome #homeowner

Join The Discussion