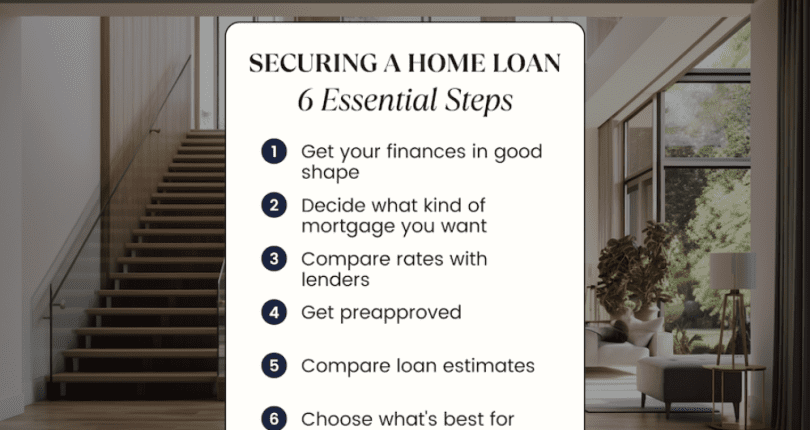

Securing A Home Loan

Getting into your dream home just got easier! As your dedicated real estate experts, we’ll help you navigate every step of your homebuying journey. Let’s turn your dream into reality. #BetterCallADeWald 503.545.4945 Securing a Home Loan: Your 6-Step Guide to Navigating the Market Embarking on the journey to homeownership can be as daunting as it […]