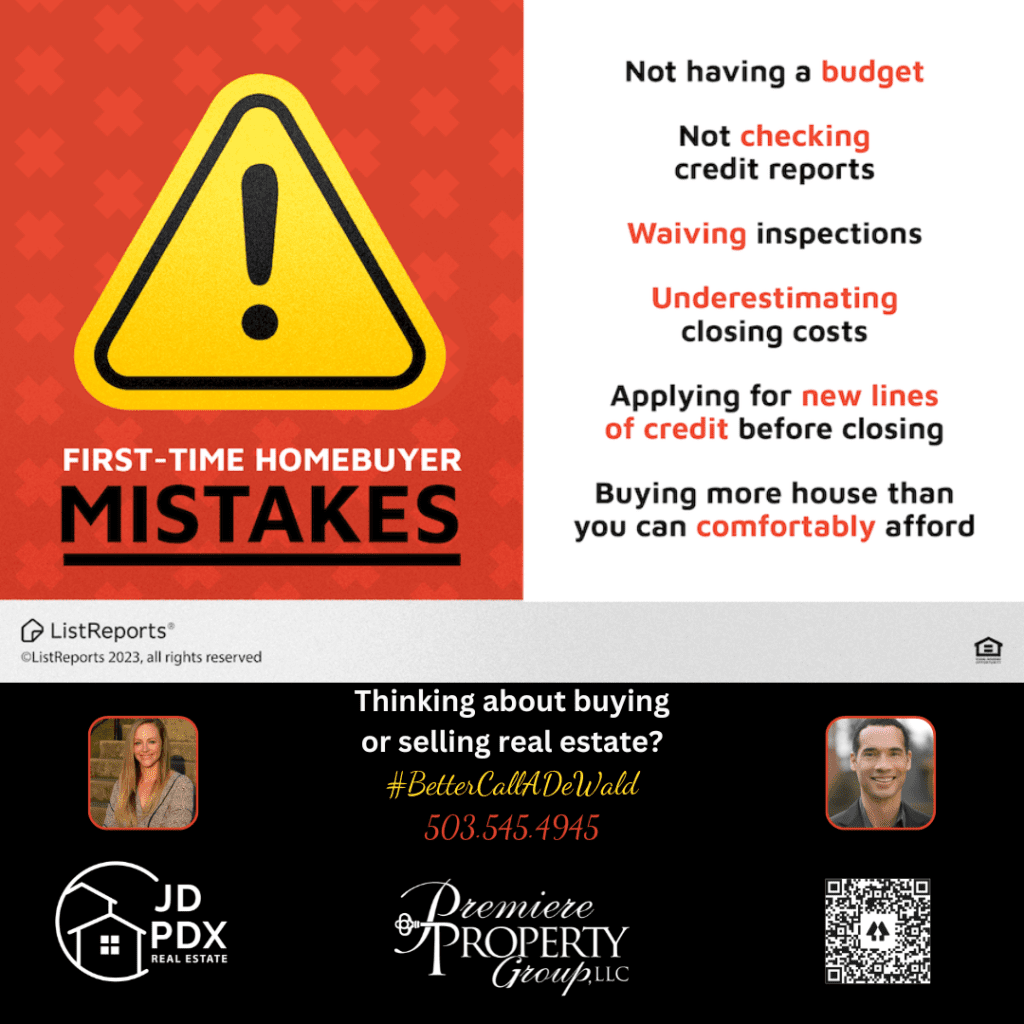

Common First Time Homebuyer Mistakes

Buying a home for the first time can be an exciting yet overwhelming experience. To help you avoid some common pitfalls, here are some mistakes that first-time homebuyers should be aware of:

- Not understanding your budget: One of the biggest mistakes is not having a clear understanding of your budget. It’s important to know how much you can afford, including not just the purchase price but also the associated costs like mortgage payments, property taxes, insurance, and maintenance expenses.

- Skipping mortgage pre-approval: Getting pre-approved for a mortgage before you start house hunting is crucial. Some first-time buyers make the mistake of assuming they will be approved for a certain amount, only to find out later that they don’t qualify. Pre-approval helps you understand your budget better and makes you a more attractive buyer to sellers.

- Neglecting additional costs: First-time homebuyers often focus solely on the purchase price but overlook additional costs such as closing costs, property inspections, appraisal fees, and potential renovations or repairs. It’s essential to budget for these expenses to avoid financial strain later on.

- Not researching loan options: There are various types of mortgage loans available, each with its own terms, interest rates, and down payment requirements. Failing to research and compare different loan options could result in missing out on a better deal or choosing a loan that doesn’t align with your financial goals.

- Overlooking hidden problems: Falling in love with a house based solely on its appearance is a common mistake. It’s crucial to have a professional home inspection to uncover any hidden problems or potential issues that may require costly repairs in the future.

- Not seeking professional advice: Real estate transactions involve complex legal and financial aspects. Some first-time buyers make the mistake of not seeking professional advice from a real estate agent, mortgage broker, or lawyer. These experts can guide you through the process, protect your interests, and help you make informed decisions.

By being aware of these common mistakes, you can navigate the homebuying process more confidently and make informed decisions along the way.