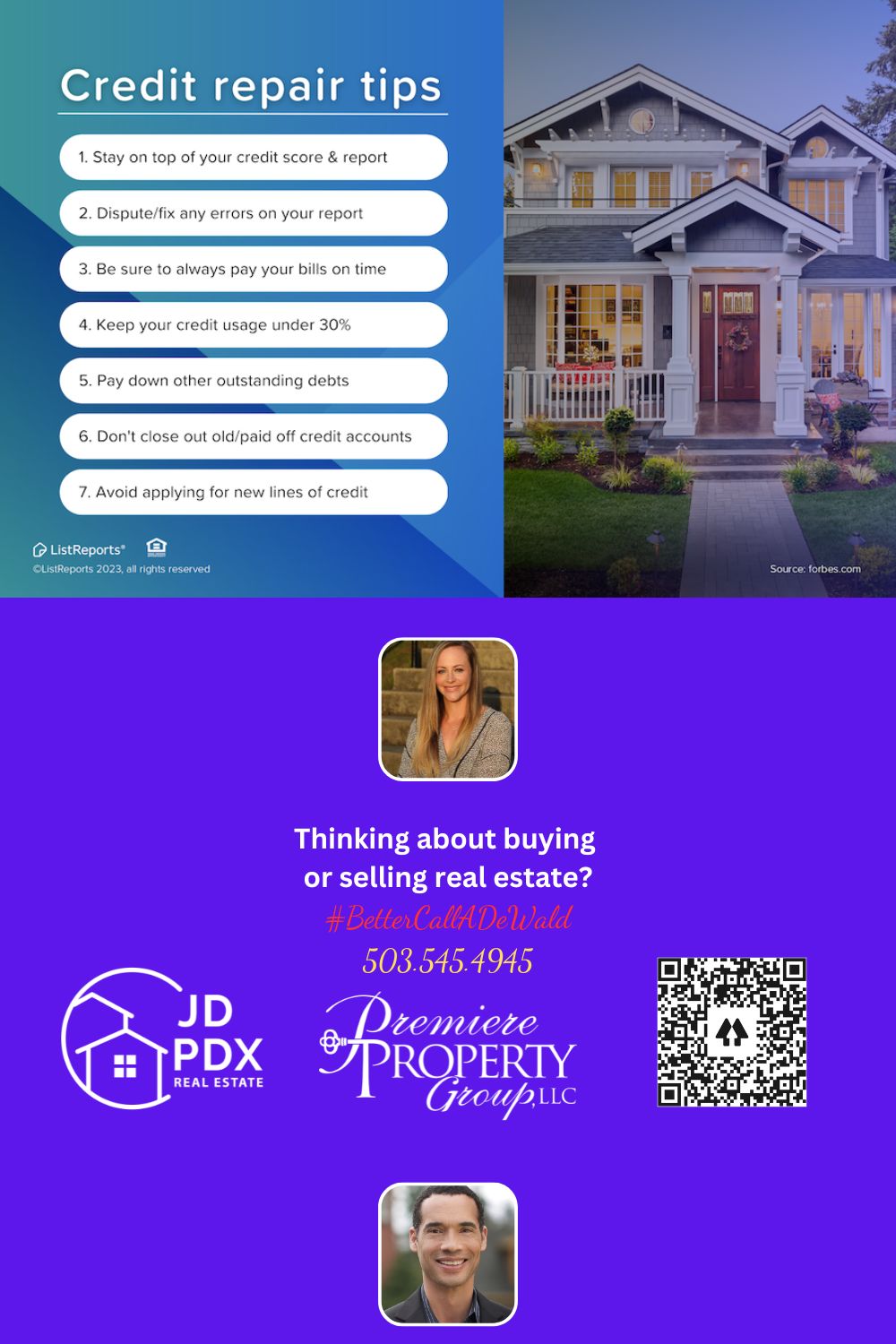

Credit Repair Tips

-

by Jamohl DeWald

by Jamohl DeWald

- May 30, 2023

- Buying Real Estate, Lending, Real Estate

- 0

Your credit score helps lenders see how you’ve handled debt in the past; the higher your score, the lower the interest rate on your mortgage might be. So, as you can imagine, it’s good to raise your score in preparation for applying for a loan.

#BetterCallADeWald 503.545.4945

Credit repair can be a complex process, but with patience and discipline, you can improve your credit score over time. Here are some tips to help you on your credit repair journey:

- Review your credit reports: Obtain copies of your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) and carefully review them for errors or inaccuracies. Dispute any incorrect information you find.

- Pay your bills on time: Late payments can significantly impact your credit score. Make sure to pay all your bills, including credit card bills, loans, and utilities, on time to establish a positive payment history.

- Reduce your credit utilization: Aim to keep your credit card balances below 30% of your credit limit. High credit utilization can negatively affect your credit score. Consider paying down debts or increasing your credit limits to achieve a lower utilization ratio.

- Establish a budget: Create a realistic budget to manage your finances effectively. This will help you prioritize payments, reduce unnecessary expenses, and allocate funds towards paying off debts.

- Avoid new credit applications: Limit new credit applications, as multiple inquiries within a short period can lower your credit score. Be selective and apply for credit only when necessary.

- Negotiate with creditors: If you’re struggling with debt, contact your creditors to discuss potential repayment options or negotiate settlements. They may be willing to work with you to create a more manageable payment plan.

- Consider credit counseling: Seek assistance from a reputable credit counseling agency. They can provide guidance on managing your finances, budgeting, and debt repayment strategies.

Remember, credit repair takes time and dedication. Be patient and consistent with your efforts, and over time, you’ll see improvements in your credit score.

#WeGotAGuy #JDPDXRealEstate #homebuyer #realestate #realtor #realestateagent #homeowner

Join The Discussion