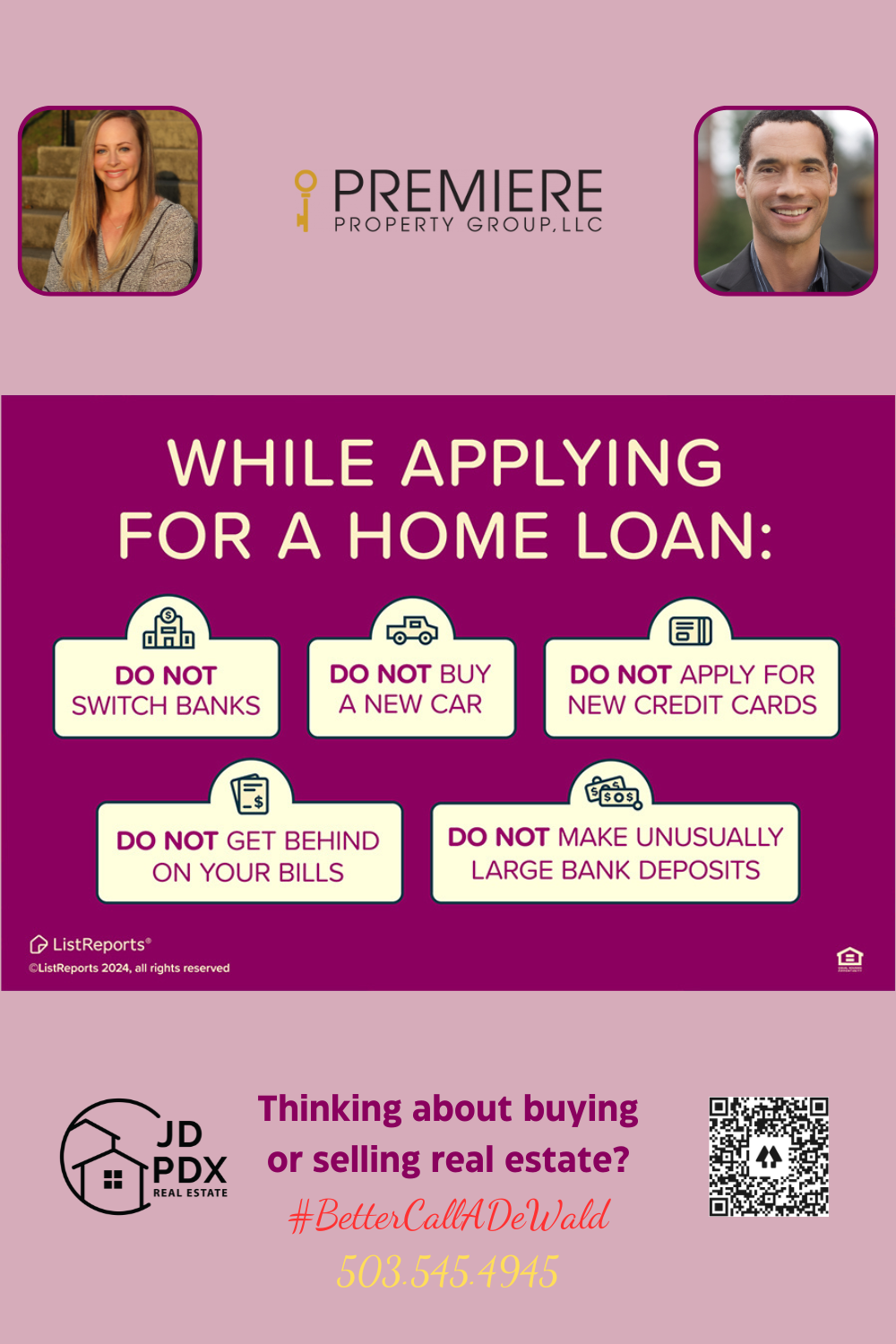

Don’t do These While Applying for a Home Loan

Ready to make your homeownership dreams a reality? Let’s keep it smooth by avoiding big financial moves until your loan is finalized! No new cars, credit cards, or major deposits—these can all impact your approval. Have questions about the process? We’re here to help every step of the way!

#BetterCallJamohl 503.545.4945

Avoid These Financial Moves to Keep Your Home Loan on Track!

Ready to make your homeownership dreams a reality? Let’s make sure your loan approval process goes as smoothly as possible. While it’s tempting to celebrate early with a big purchase or financial change, certain moves can impact your approval status.

Until your loan is finalized, it’s essential to hold off on big financial decisions. Avoid buying a new car, opening new credit cards, or making large deposits. These actions can alter your credit score or debt-to-income ratio, potentially raising red flags for lenders. Even if you’re confident about your finances, these changes can delay the process or impact your interest rate.

We understand that navigating the loan process can feel overwhelming, especially with so many details to keep track of. That’s why we’re here to help! Our team will guide you through every step, providing reliable advice and answering any questions you have along the way.

Let’s work together to ensure a smooth journey to closing day. With a little caution and our expert support, you’ll be holding the keys to your new home in no time! Ready to get started? Reach out today!

#Homebuyer #JDPDXRealEstate #realestate #investment #realtor #realestateagent

Join The Discussion