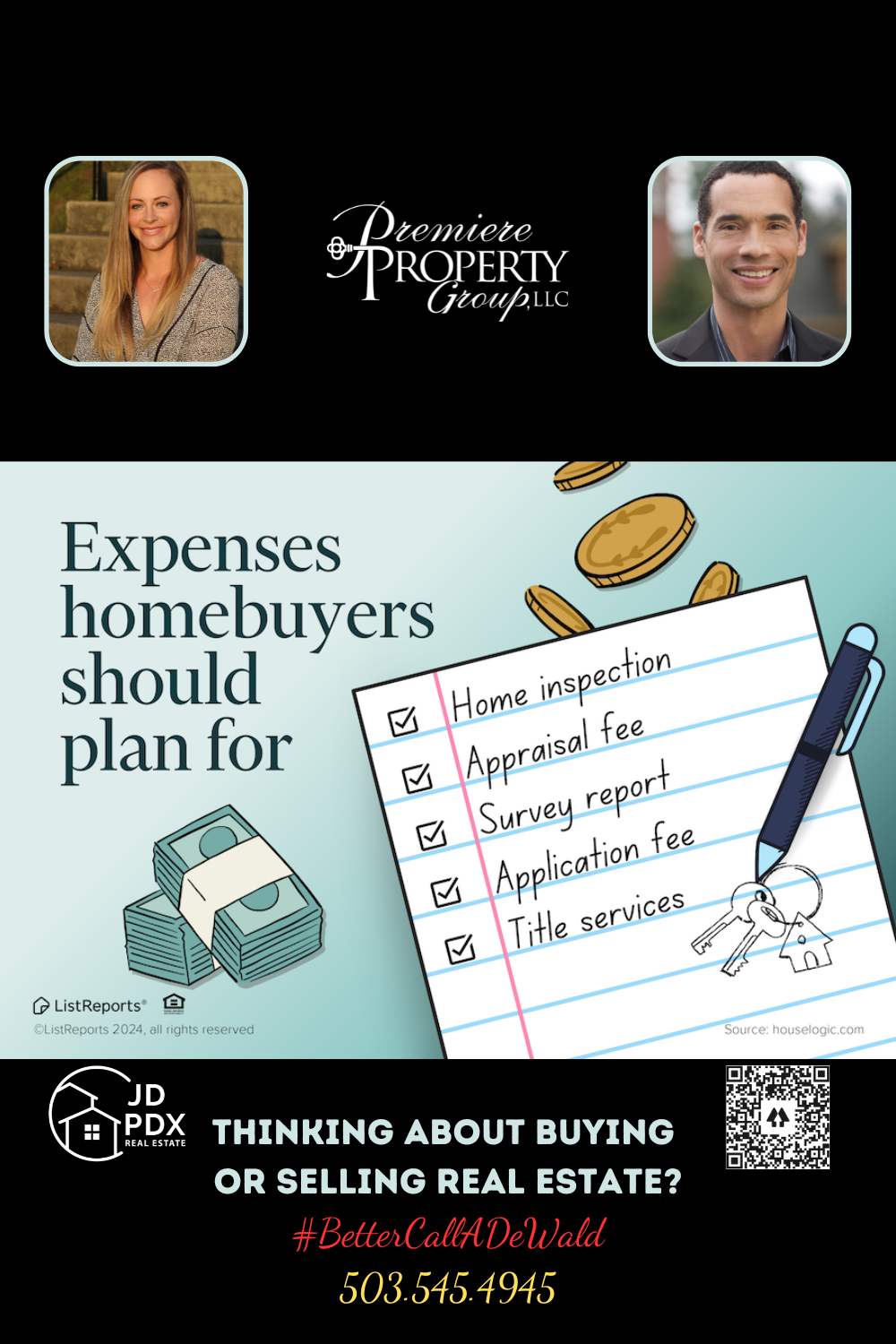

Expenses Homebuyers Should be Prepared For

Don’t let home expenses catch off guard, be prepared. We can help you be in the know and have a plan. Let’s talk! Below we share some expenses homebuyers should be prepared for.

#BetterCallJamohl 503.545.4945

Navigating the waters of home buying can be tricky, especially when unexpected costs arise. But worry not, because with the right knowledge and preparation, you can sail smoothly towards owning your dream home without financial surprises throwing you off course. Here’s what every savvy homebuyer should factor into their budget.

1. Home Inspection: This is the first line of defense against future expenses. Also, a thorough home inspection can spot potential problems before they become your financial headaches.

2. Appraisal Fees: Lenders require a home appraisal to ensure the property’s value matches the sale price. Plus, It’s a crucial step in securing your mortgage.

3. Application Fee: Often overlooked, this fee covers the cost of processing your mortgage application.

4. Title Services: Ensuring the property title is clear from liens or disputes will give you peace of mind in your investment.

Again, don’t let these additional expenses catch you off guard. As your dedicated real estate guide, we’re here to ensure you’re informed and prepared every step of the way. Lastly, with a solid plan in place, the path to your new home will be as clear and straightforward as possible. Ready to talk strategy? Let’s connect and make your home-buying experience a planned success story!

#JDPDXRealEstate #realestate #realtor #realestateagent #homeowner #homebuyer #FirstTimeHomeBuyer

Join The Discussion