Exploring Your Down Payment Options

-

by Jamohl DeWald

by Jamohl DeWald

- November 2, 2023

- Buying Real Estate, First Time Homebuyer

- 0

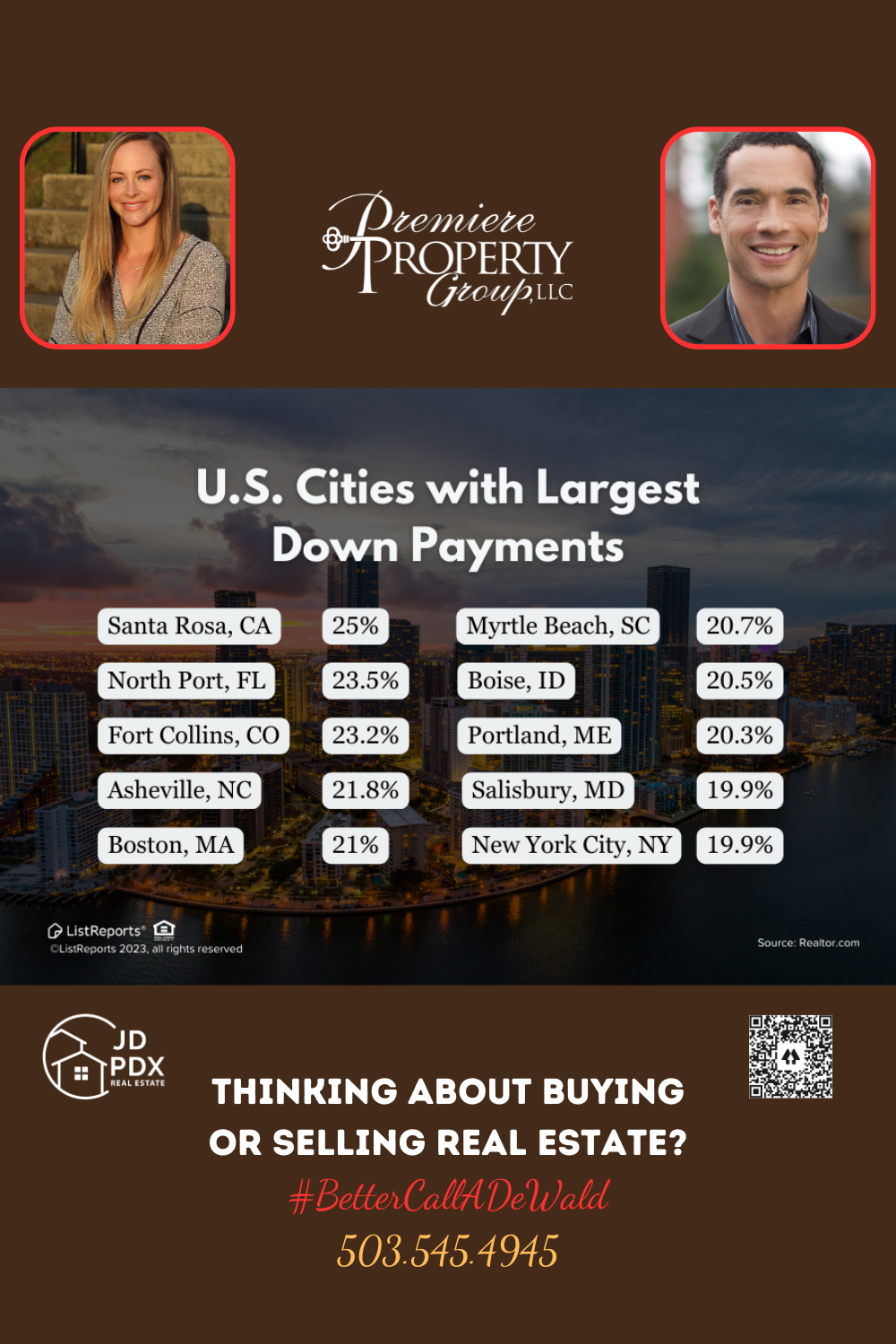

You don’t need a mountain of cash to unlock the door to your dream home. While these numbers cite the cities with the largest down payments, anything over 20% is not realistic for most people due to income restraints, housing prices, inflation and other financial commitments. Send us a message and let us explain why buying a home is still possible, even with little to no money down.

#BetterCallADeWald 503.545.4945

Exploring Your Down Payment Options: Making Homeownership Possible

When it comes to buying your first home, the down payment is a crucial factor. As a first time homebuyer, you have several options to choose from when it comes to covering this initial cost. In this blog post, we’ll explore some of these down payment options, making the path to homeownership more accessible.

- Savings: The most traditional route is to save up a portion of the home’s purchase price. The recommended down payment is typically 20%, but some loans accept as little as 3% down.

- Gift Funds: Family members or friends can gift you the down payment money. It’s important to follow specific guidelines for documenting these gifts.

- Down Payment Assistance Programs: Many local and federal programs offer financial assistance to first time homebuyers, helping them cover their down payments and closing costs.

- 401(k) or IRA Withdrawals: In some cases, you can withdraw funds from your retirement accounts penalty-free to use as a down payment.

- Low-Down-Payment Loans: Various mortgage programs, such as FHA loans, offer low down payment options, allowing you to become a homeowner with as little as 3.5% down.

Exploring these down payment options can make homeownership a reality for first time buyers. Consider your financial situation and future goals to determine which option is best for you.

#realestate #realestateagent #JDPDXRealEstate #homeowner #homeownership #homebuying #homesearch #buyingahome #Homebuyer