Factors That Affect Your Interest Rate

-

by Jamohl DeWald

by Jamohl DeWald

- December 28, 2023

- Buying Real Estate, First Time Homebuyer

- 0

When it comes to the exciting journey of buying a home, understanding the factors that influence interest rates is key. From economic conditions and market trends, to credit scores and loan duration, a lot is taken into account before arriving at your final rate. If you’re ready to buy, send us a message — we’d love to chat! Below we go over some factor that affect your interest rate.

#BetterCallJamohl 503.545.4945

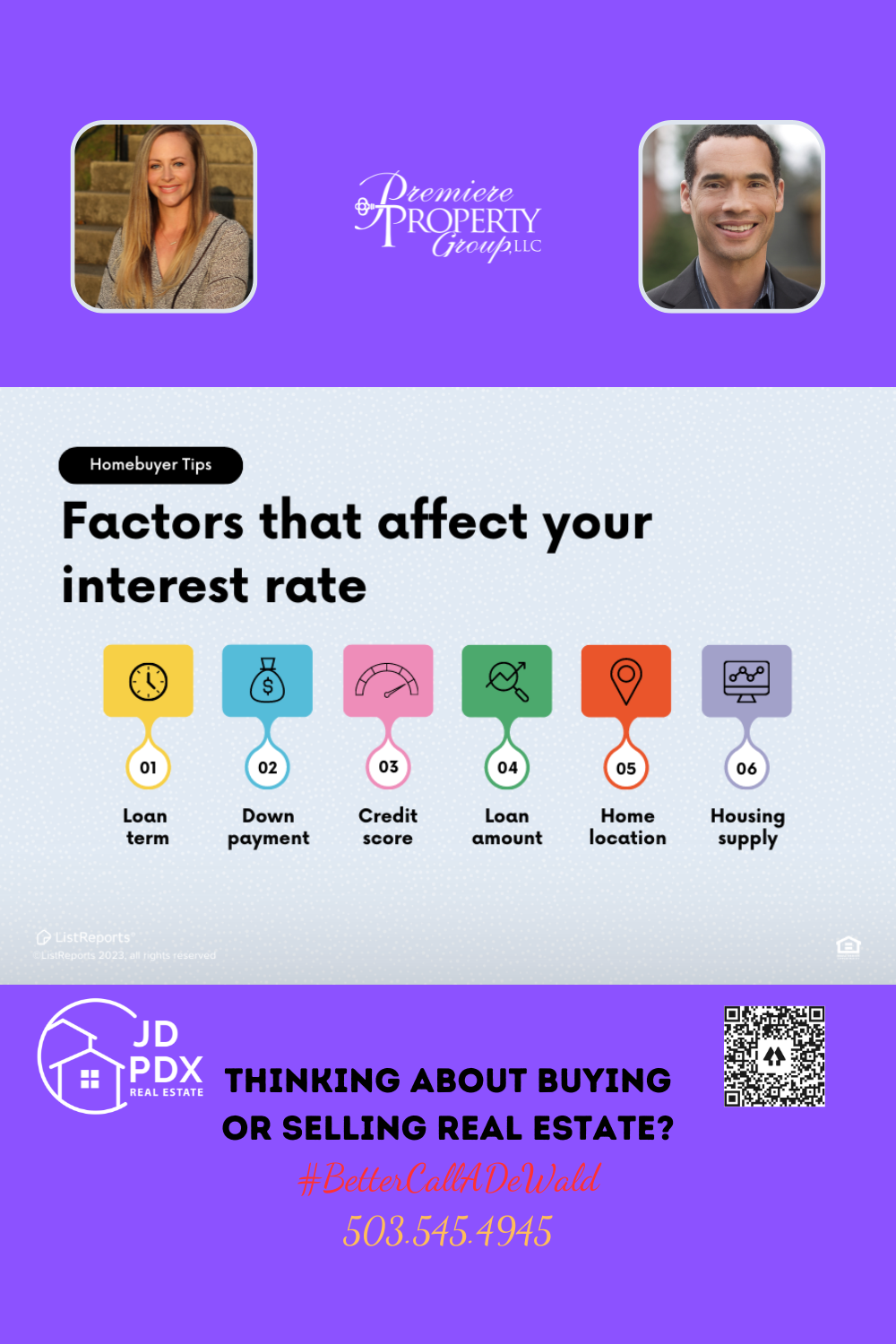

Factors That Affect Your Interest Rate When Buying a Home

As a first time home buyer or seasoned real estate investor, understanding the factors influencing your mortgage interest rate is crucial. Interest rates can significantly impact your monthly payments and the overall cost of your home.

- Credit Score: Your credit score is pivotal. Higher scores often secure lower interest rates, as they indicate a lower risk to lenders.

- Down Payment: The more you put down, the lower your interest rate might be. A substantial down payment reduces the lender’s risk.

- Loan Type: Whether it’s a fixed-rate or adjustable-rate mortgage, each has different interest rate implications.

- Loan Term: Shorter loan terms typically have lower interest rates but higher monthly payments compared to longer terms.

- Economic Factors: The overall economic environment, including inflation and Federal Reserve policies, influences interest rates.

- Property Location and Type: Rates can vary depending on the location and type of property you’re purchasing.

By understanding these factors, you can better navigate your home buying journey. Consult with a trusted real estate agent to explore your options and secure the best possible rate.

#Homebuyer #realestateagent #JDPDXRealEstate #realestate #homeowner #homeownership #homebuying #homesearch