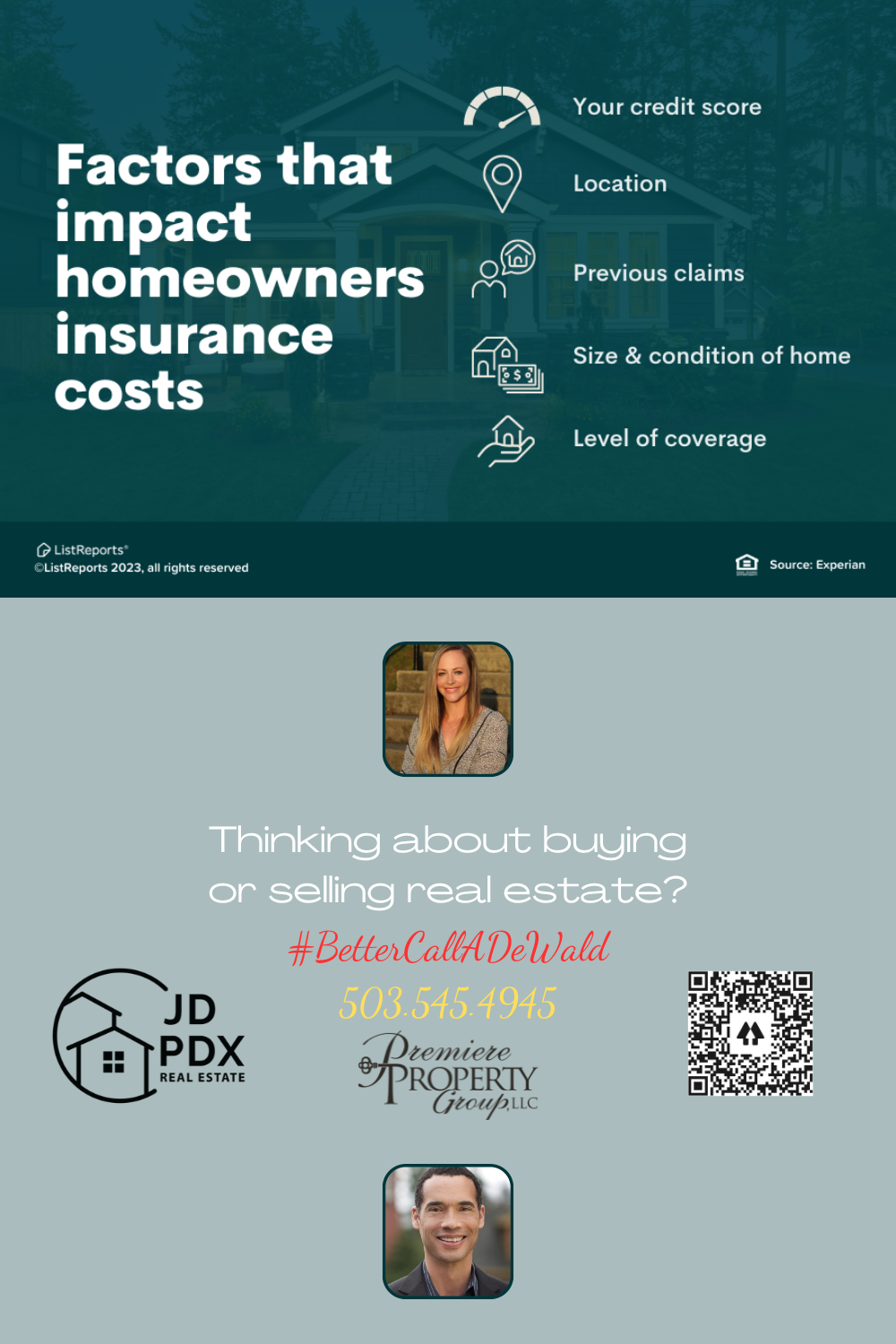

Factors That Impact Homeowners Insurance

-

by Jamohl DeWald

by Jamohl DeWald

- July 2, 2023

- Buying Real Estate, First Time Homebuyer, Insurance

- 0

Just like car insurance, there are many factors that determine your home insurance premiums. TLDR: it’s all about perceived risk levels. Be sure to shop around before settling on the first quote you receive, and revisit your policy every few years to see if you can save! Below are some factors that impact homeowners insurance.

BetterCallADeWald 503.545.4945

Several factors can impact homeowners insurance rates and coverage. Here are some key factors:

-

- Location: The location of your home plays a significant role in determining insurance rates. Factors such as proximity to coastlines, flood-prone areas, or regions prone to natural disasters like earthquakes or wildfires can increase premiums. The crime rate in the area and the availability of local fire protection services also affect rates.

-

- Home characteristics: The characteristics of your home, including its age, size, construction type, and overall condition, can impact insurance rates. Older homes may have higher rates due to the potential for outdated wiring, plumbing, or structural issues. Homes made of fire-resistant materials like brick typically have lower rates.

-

- Replacement cost: The cost to rebuild or repair your home in the event of damage or loss is a crucial factor. Insurance companies consider factors such as the square footage, construction materials, and local building costs to determine the replacement cost. Higher replacement costs lead to higher premiums.

-

- Deductible: The deductible is the amount you’re responsible for paying before the insurance coverage kicks in. Choosing a higher deductible can lower your premiums but also means you’ll have to pay more out of pocket in the event of a claim.

-

- Coverage limits: The amount of coverage you choose for your home and belongings affects your premiums. Higher coverage limits result in higher premiums. It’s important to assess your needs and strike a balance between adequate coverage and affordability.

-

- Claims history: Insurance companies may consider your claims history when determining premiums. If you’ve had multiple claims in the past, especially for similar types of damage, it may lead to higher rates. Conversely, a claim-free history can sometimes lead to discounts.

-

- Credit score: In some states and countries, insurers may consider your credit score when calculating homeowners insurance rates. Studies have shown a correlation between lower credit scores and higher insurance claims, so a poor credit score may lead to higher premiums.

-

- Liability coverage: Liability coverage protects you if someone gets injured on your property and sues you. Higher liability coverage limits can increase premiums, but it’s important to have adequate protection to safeguard your assets.

It’s essential to consult with insurance professionals and providers to understand how these factors specifically impact your homeowners insurance rates and coverage.

#realestate #realestateagent #JDPDXRealEstate #homeowner #dreamhome #homeownership #homebuying #homesearch #buyingahome