Factors That Influence Interest Rates

-

by Jamohl DeWald

by Jamohl DeWald

- August 22, 2023

- Buying Real Estate

- 0

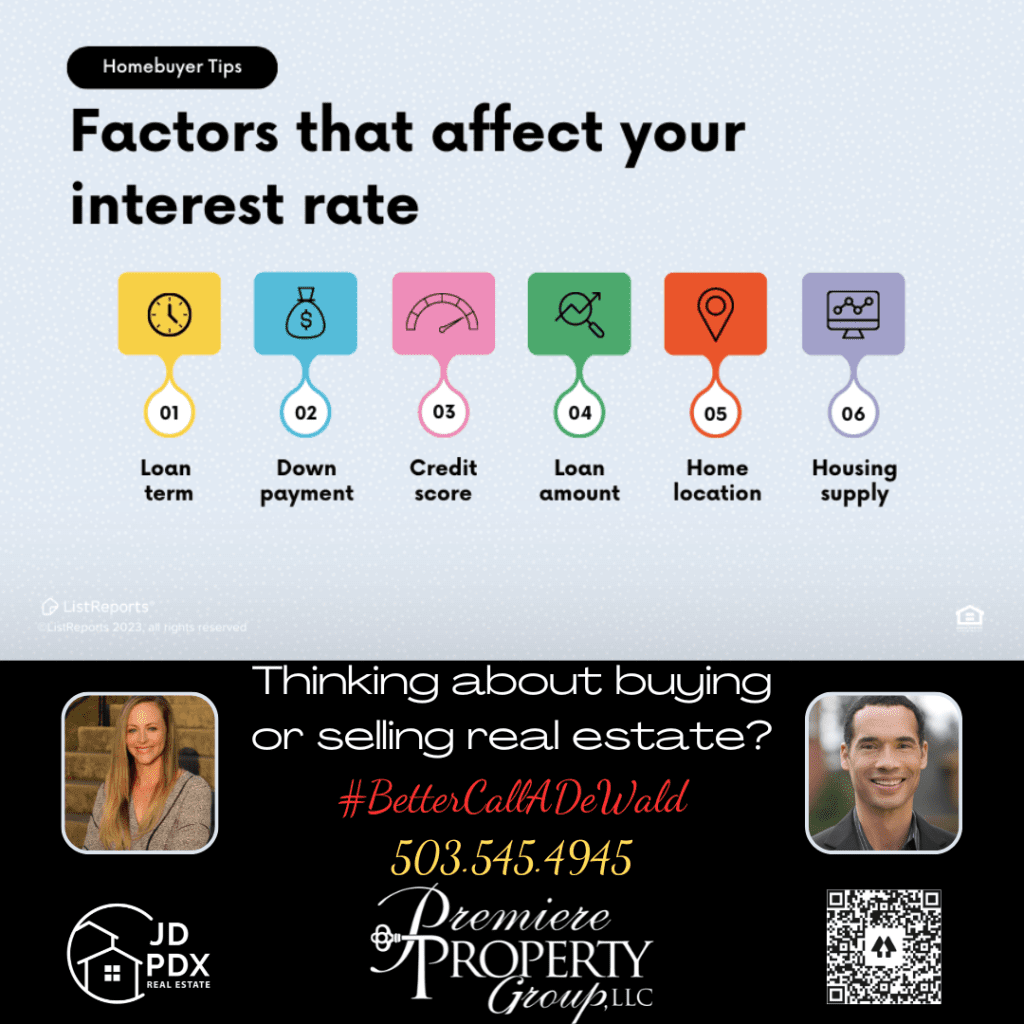

When it comes to the exciting journey of buying a home, understanding the factors that influence interest rates is key. From economic conditions and market trends, to credit scores and loan duration, a lot is taken into account before arriving at your final rate. If you’re ready to buy, send us a message — We’d love to chat!

#BetterCallADeWald 503.545.4945

Understanding the Factors that Impact Interest Rates

Interest rates play a crucial role in various financial transactions, especially loans and credit. Several key factors influence these rates:

- Economic Conditions: The overall health of the economy, including inflation, unemployment rates, and economic growth, can influence interest rates. Central banks may adjust rates to stimulate or cool down economic activity.

- Central Bank Policies: Central banks like the Federal Reserve set the benchmark interest rates for a country. Changes in these rates can have a ripple effect on other interest rates across the economy.

- Inflation: Higher inflation erodes purchasing power, causing central banks to raise interest rates to curb spending and maintain price stability.

- Supply and Demand: The demand for credit and available funds in the lending market can affect interest rates. High demand for loans can lead to higher rates.

- Credit Risk: Borrowers’ creditworthiness affects the perceived risk for lenders. Lower credit scores may result in higher interest rates to compensate for the risk.

- Loan Term: Short-term loans often have lower interest rates than long-term loans due to the risk and uncertainty associated with longer repayment periods.

- Global Influences: International economic conditions, geopolitical events, and exchange rates can impact interest rates in interconnected economies.

- Market Competition: Lenders’ competition for borrowers can drive interest rates down, benefiting consumers.

- Government Policies: Fiscal policies, such as taxation and government spending, can indirectly influence interest rates by affecting overall economic conditions.

- Borrower Factors: The loan amount, down payment, and type of loan can influence the interest rate a borrower receives.

Being aware of these factors can help individuals and businesses make informed decisions about borrowing and investing, as interest rates significantly impact financial outcomes.

#realestate #realestateagent #JDPDXRealEstate #homeowner #homebuyer #homeownership #homebuying #buyingahome