FICO Score

A FICO score is used to help a lender calculate how much money to loan a borrower. It’s based on credit reports. The higher the score the better. But, don’t let a lower score keep you from pursuing a home, it is just one part of how you qualify for a mortgage.

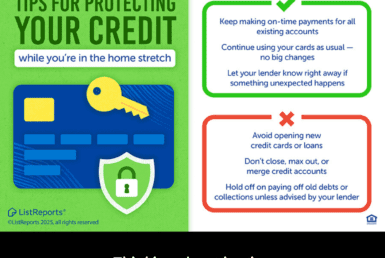

Qualifying for a mortgage loan can be a complex process, but it doesn’t have to be overwhelming. To qualify for a mortgage loan, the primary requirements are a good credit score and a sufficient income. Your credit report should be free of any major derogatory marks, such as collections, bankruptcies, or foreclosures. Additionally, you should have a consistent employment history and a stable income.

To determine how much you can borrow, lenders may use a debt-to-income ratio (DTI) calculation. This calculation compares your monthly expenses to your monthly income and can help lenders determine how much you can afford. Finally, you may also need to provide evidence of assets, such as bank statements or retirement account statements.

If you have any more questions about your FICO score or want more information regarding mortgage qualifications, please don’t hesitate to reach out. We are here to help you navigate the mortgage process!

#BetterCallADeWald 503.545.4945

Join The Discussion