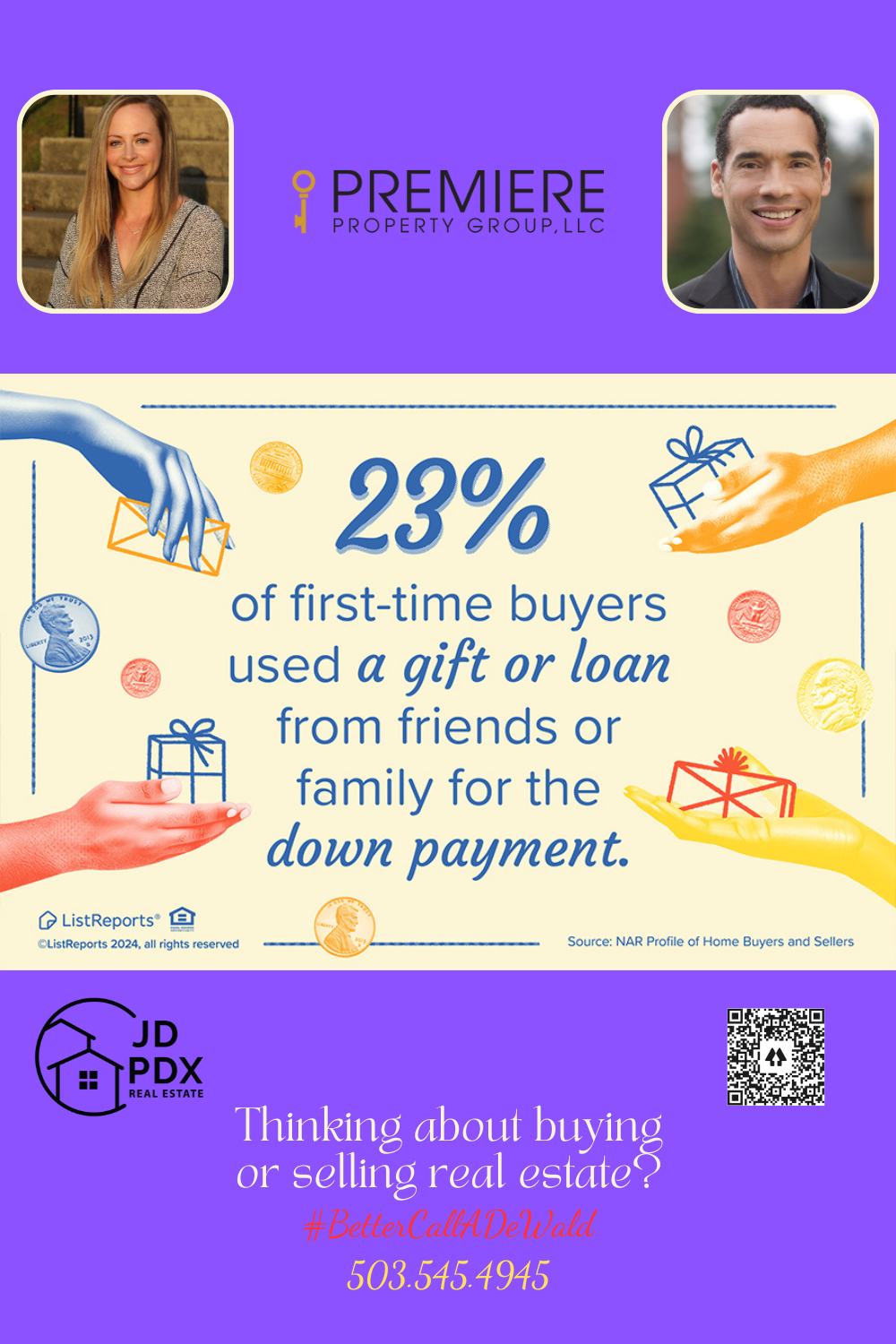

First Time Homebuyer Down Payment

Did you know that nearly a quarter of first-time homebuyers use gifts or loans from friends or family for their down payment? If you’re looking to buy your first home, we’re here to help you navigate the process and find the perfect place. Ready to take the first step? Contact us today to get started!

#BetterCallJamohl 503.545.4945

Understanding the First-Time Homebuyer Down Payment

Buying your first home is an exciting milestone, but navigating the financial aspects—especially the down payment—can feel a bit overwhelming. Don’t worry; we’re here to guide you every step of the way, making the process as smooth and stress-free as possible.

The down payment is often the largest upfront cost for first-time buyers. While many assume they need 20%, the truth is that first-time buyers frequently qualify for programs requiring much less—sometimes as low as 3% or even zero down with certain loan options. Additionally, resources like down payment assistance programs, grants, or gifts from family can help bridge the gap and make homeownership more attainable.

It’s important to plan beyond the down payment, though. Closing costs, moving expenses, and ongoing homeownership responsibilities are part of the equation, too. That’s where we come in. We’ll not only help you understand your options but also connect you to trusted lenders and resources to ensure you’re fully prepared for the journey ahead.

Our goal is to be your trusted partner, offering expertise and reassurance as you take this exciting step toward homeownership. Have questions about down payments or the home-buying process? Send us a message—we’re here to help!

#homebuyer #JDPDXRealEstate #realestate #investment #realtor #realestateagent

Join The Discussion