Get in Position to Buy a Home

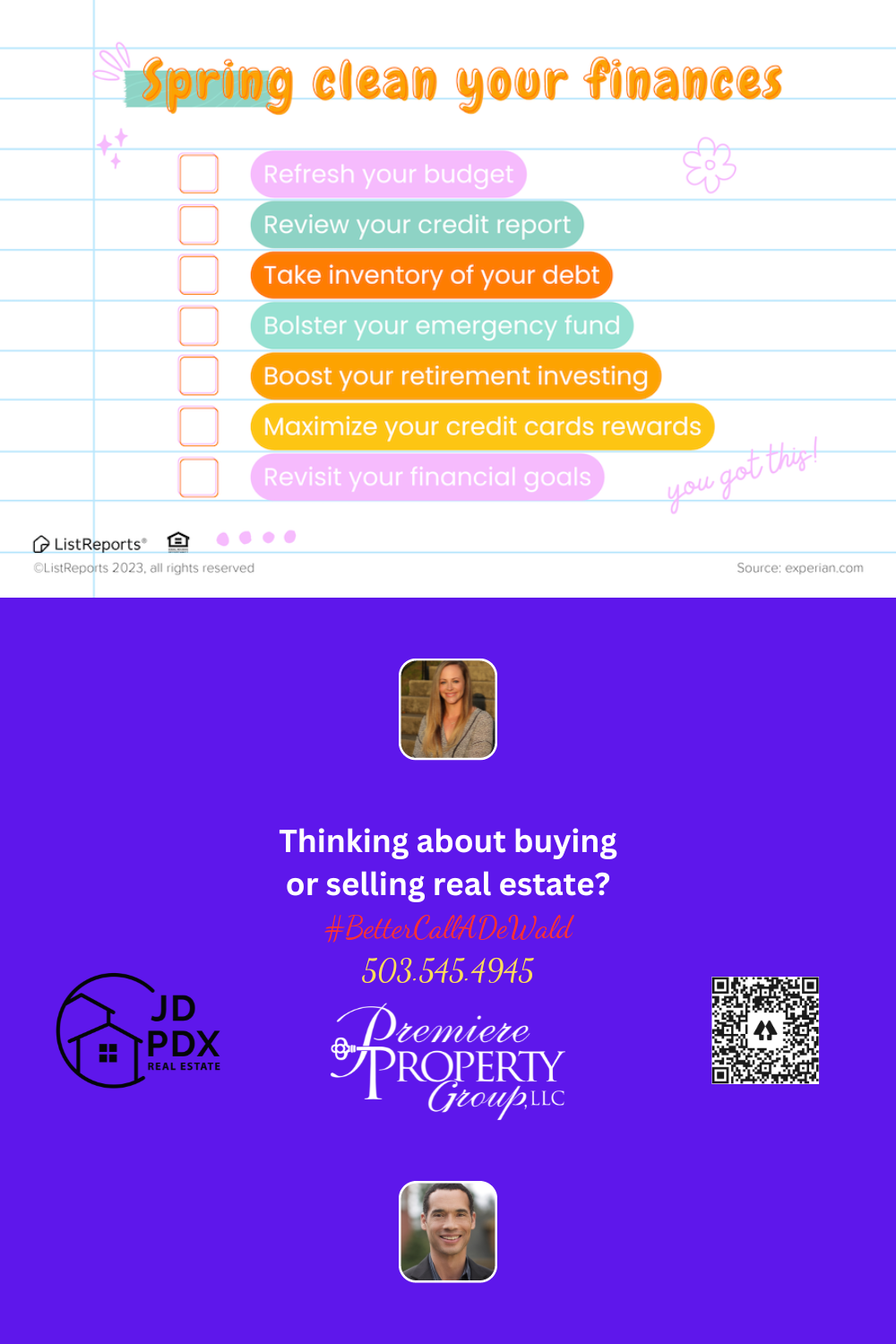

The Spring season is in full swing, and it’s time to wipe away the dust and grime from winter. But this physical and mental refresh doesn’t just apply to your home. Use these seven steps to clean up your finances!

#BetterCallADeWald 503.545.4945

Buying a home is a significant investment, and it’s essential to prepare yourself financially and strategically to be in the best position to make a successful purchase. Here are some steps you can take to get into the best position to buy a home:

- Determine your budget: Before you start house-hunting, you need to know how much you can afford to spend on a home. This involves looking at your income, expenses, and debts to calculate what you can comfortably afford to pay each month.

- Get pre-approved for a mortgage: Once you know your budget, you can get pre-approved for a mortgage. This involves working with a lender to determine how much they are willing to lend you based on your income, credit score, and other factors.

- Save for a down payment: Most lenders require a down payment of at least 3.5% of the home’s purchase price. Saving for a down payment can take time, but it can help you get a better interest rate and save money in the long run.

- Improve your credit score: Your credit score plays a significant role in determining the interest rate you’ll receive on your mortgage. To get a better rate, you’ll want to have a credit score of at least 700.

- Work with a real estate agent: A good real estate agent can help you find the right home for your needs and budget. They can also help you negotiate the purchase price and guide you through the home buying process.

- Be prepared to act quickly: In a competitive housing market, it’s essential to be ready to act quickly when you find a home you want to buy. This means having your finances in order and being prepared to make an offer as soon as possible.

By following these steps, you can position yourself to be in the best position to buy a home and make a successful purchase.

#JDPDXRealEstate #homebuyer #homeowner #finances #realestate #realtor #realestateagent

Join The Discussion