Getting Prepared For Home Buying Costs

-

by Jamohl DeWald

by Jamohl DeWald

- August 8, 2023

- Buying Real Estate, First Time Homebuyer

- 0

While the idea of homeownership might seem daunting at first, remember that every cost comes with incredible benefits. Build equity, secure your family’s future, and enjoy tax advantages – all while creating a space that truly reflects YOU! Let’s turn your homeownership dream into a reality together.

#BetterCallADeWald 503.545.4945

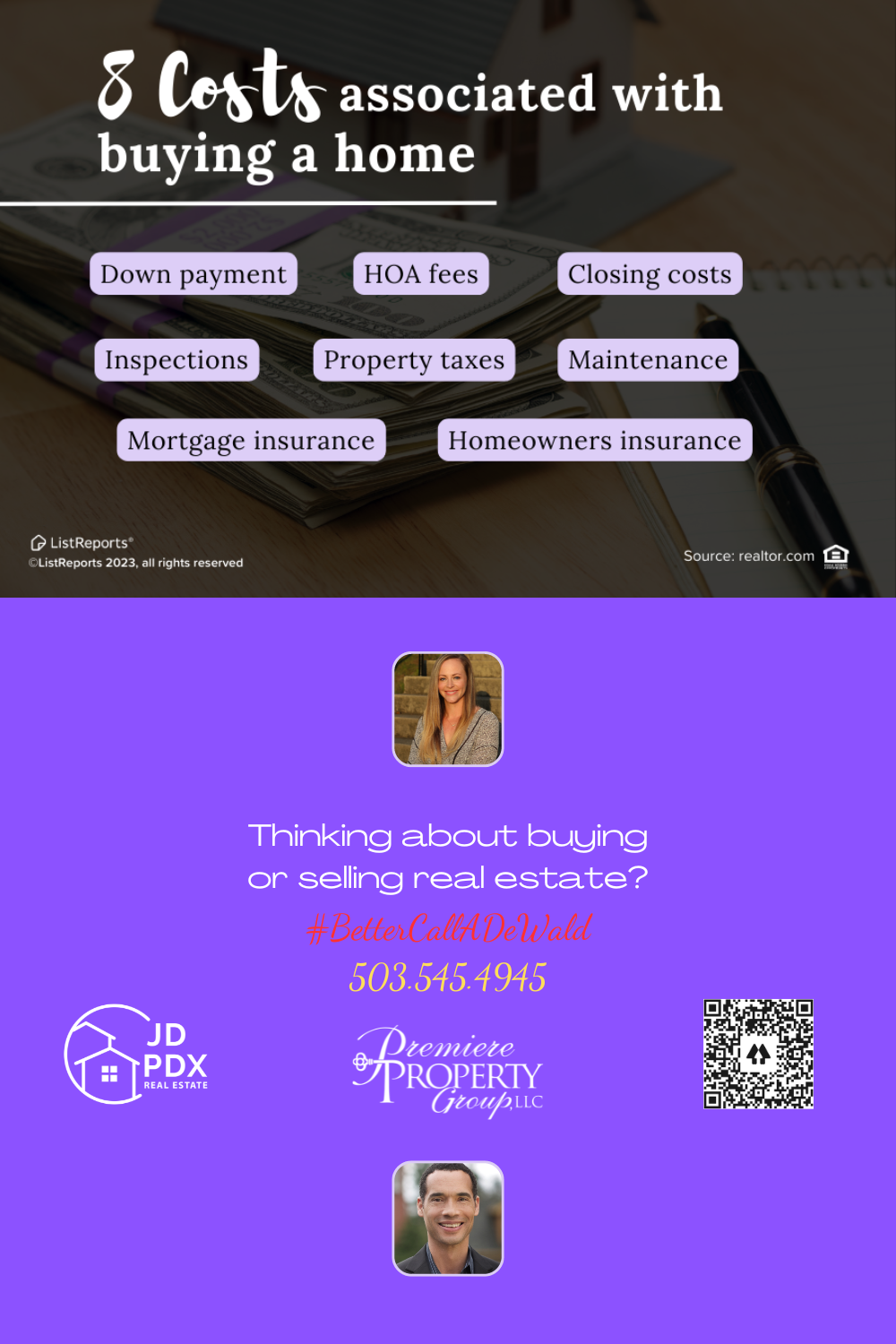

Preparing for home buying involves careful financial planning and consideration of various costs associated with the process. First and foremost, one should assess their credit score and financial standing to determine their eligibility for a mortgage and secure the best interest rates.

A crucial aspect is saving for a down payment, typically ranging from 3% to 20% of the home’s value. Setting aside funds for closing costs, which cover fees such as appraisal, inspection, is equally essential.

Future homeowners should also factor in moving expenses, which may include hiring movers, purchasing packing supplies, and transportation costs.

Ongoing homeownership costs like property taxes, homeowners insurance, and utilities must be budgeted for as well.

Before making a purchase, a home inspection is advisable to identify any potential repair or maintenance costs.

Finally, it’s vital to account for unexpected expenses, such as home repairs or emergencies.

By carefully preparing and budgeting for these costs, potential homebuyers can confidently enter the real estate market and achieve their homeownership dreams.

#realestate #realestateagent #JDPDXRealEstate #homeowner #homeownership #homebuying #homesearch #buyingahome