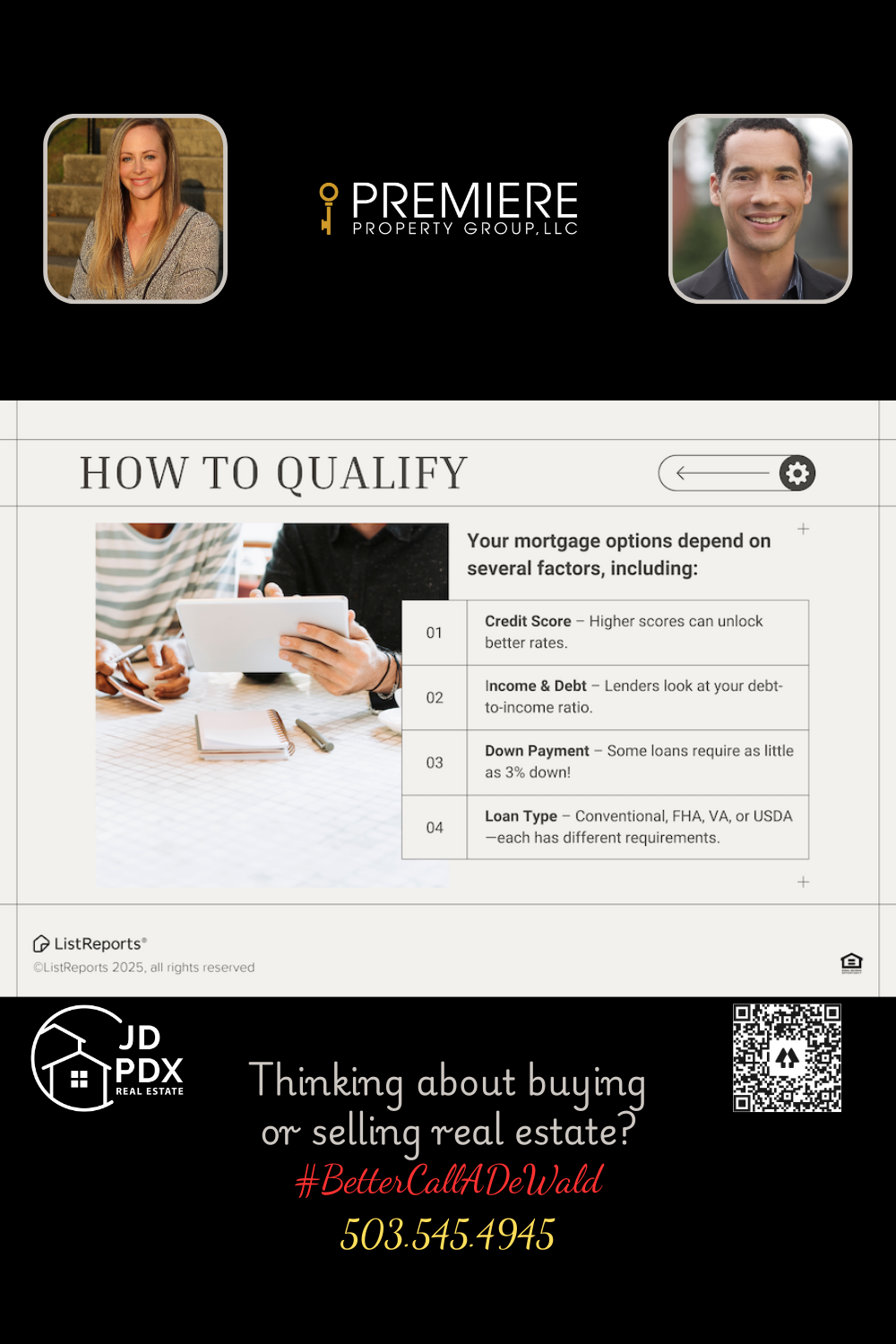

How to Qualify For a Home Loan

Your dream home might be closer than you think! The type of mortgage you qualify for depends on factors like credit score, income, and down payment—but there are options for all kinds of buyers. Some loans require as little as 3% down, making homeownership more achievable than you might realize! Ready to explore your options? Let’s chat and find the right path for you!

#BetterCallJamohl 503.545.4945

How to Qualify For a Home Loan

Your dream home might be closer than you think! Whether you’re a first-time homebuyer or ready to upgrade, understanding how to qualify for a home loan is the first step. Mortgage lenders look at several key factors—including your credit score, income, debt-to-income ratio, and available down payment. But don’t worry—there’s no one-size-fits-all, and there are options available to fit a variety of financial situations.

You don’t need a massive down payment to get started. In fact, some loan programs require as little as 3% down, and government-backed options like FHA, VA, and USDA loans offer even more flexibility. A higher credit score can help you lock in better rates, but that doesn’t mean perfect credit is required to qualify.

We’re here to help you understand your options and feel confident about the process. Whether you’re just starting to save or ready to get pre-approved, we’ll connect you with trusted lending professionals and provide support every step of the way. Let’s talk about your goals and create a plan that gets you home.

Thinking about buying? Let’s find the right loan—and the right home—for you.

#HomeLoanHelp #MortgageTips #FirstTimeHomebuyer #BetterCallADeWald

#Homebuyer #JDPDXRealEstate #investment #realestate #realestateagent #realtor #househunting #dreamhome

Join The Discussion