How to Raise Your Credit Score

-

by Jamohl DeWald

by Jamohl DeWald

- June 29, 2023

- First Time Homebuyer, Lending

- 0

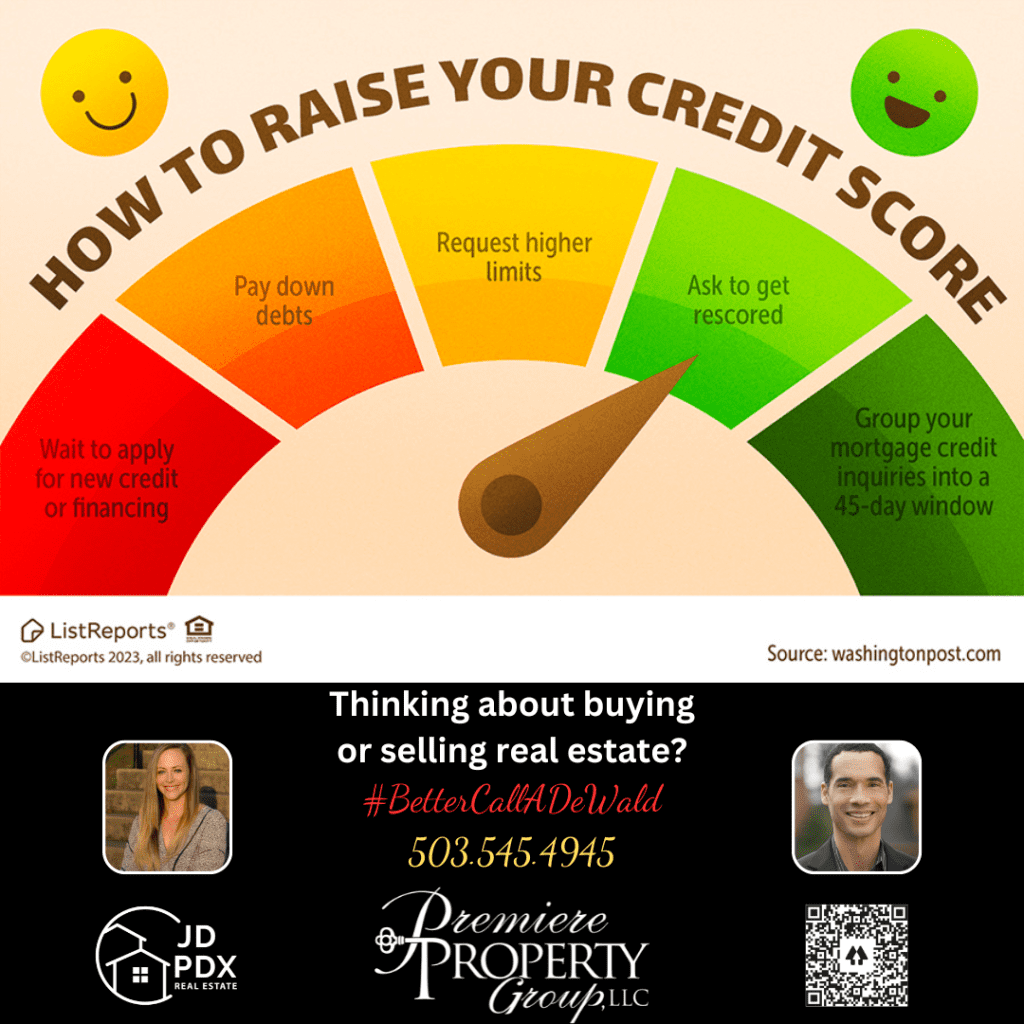

Nothing is written in stone, not even your credit score. If you think your credit score needs a boost before applying for a mortgage, these tips can help. Below are some tips on how to raise your credit score.

#BetterCallADeWald 503.545.4945

Raising your credit score is an important step towards improving your financial health. A higher credit score can help you secure better interest rates on loans, qualify for credit cards with attractive rewards, and even lower your insurance premiums. Here are some tips to help you raise your credit score:

- Pay your bills on time: Payment history is a significant factor in determining your credit score. Make sure to pay all your bills, including credit cards, loans, and utilities, on time. Late payments can have a negative impact on your credit score.

- Reduce your credit card balances: Try to keep your credit card balances low. High credit card utilization (the ratio of your credit card balances to your credit limits) can lower your credit score. Aim to keep your utilization below 30% and ideally pay off your balances in full each month.

- Avoid applying for new credit frequently: Every time you apply for new credit, it generates a hard inquiry on your credit report, which can temporarily lower your credit score. Limit your credit applications and only apply for credit when necessary.

- Maintain a diverse credit mix: Lenders like to see a mix of different types of credit, such as credit cards, loans, and a mortgage. Having a variety of credit accounts and managing them responsibly can positively impact your credit score.

- Keep old accounts open: The length of your credit history is an important factor in determining your credit score. If you have old credit card accounts with positive payment history, consider keeping them open even if you’re not actively using them. Closing old accounts can shorten your credit history and potentially lower your credit score.

- Regularly check your credit reports: Monitor your credit reports from the three major credit bureaus (Experian, TransUnion, and Equifax) to ensure they are accurate. Look for any errors or discrepancies that could be negatively affecting your credit score. You are entitled to one free credit report from each bureau annually at AnnualCreditReport.com.

- Avoid collections and public records: Try to avoid having any accounts go into collections or obtaining public records, such as bankruptcies or tax liens. These negative marks can significantly lower your credit score and take time to recover from.

- Be patient and consistent: Building good credit takes time and requires consistent positive financial habits. Stay disciplined, make timely payments, and manage your credit responsibly. Over time, your credit score will gradually improve.

Remember, improving your credit score is a long-term process, and there are no quick fixes. It requires responsible financial habits and patience.

#JDPDXRealEstate #creditscore #realestate #homebuyer #homeowners #realestateagent #realtor

Join The Discussion