Mortgage Rate Tips

-

by Jamohl DeWald

by Jamohl DeWald

- March 14, 2023

- Buying Real Estate, Mortgage, Real Estate

- 0

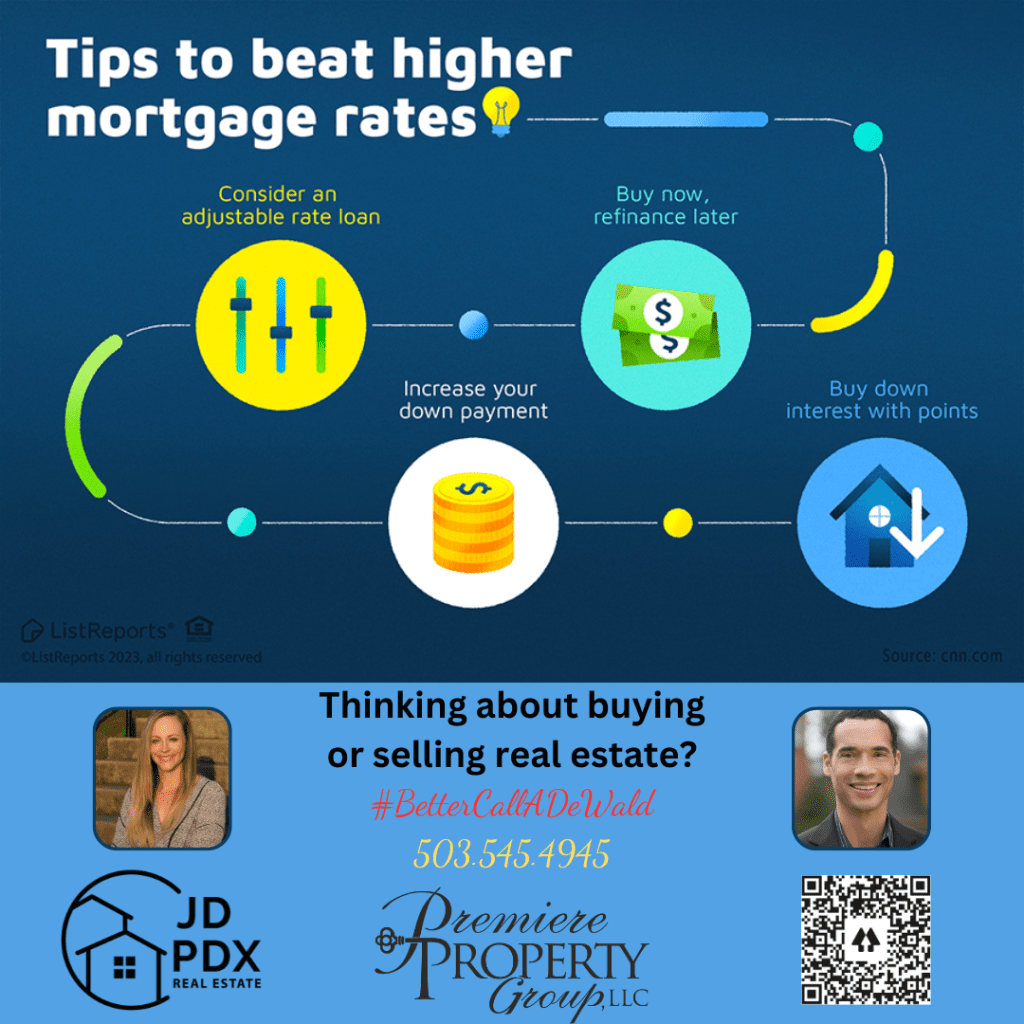

When buying a home, you must know how much you can afford. Understanding all of the details of your mortgage and knowing money-savvy tips to help you save is important too! We can help you navigate this trickiness with the mortgage rate tips below; send us a message!

#BetterCallADeWald 503.545.4945

Here are some tips for getting a favorable mortgage rate:

- Improve your credit score: A higher credit score can help you secure a lower mortgage rate. Aim for a score of at least 700 to qualify for the best rates.

- Save for a larger down payment: Lenders typically offer lower interest rates to borrowers who make larger down payments. Save up at least 20% of the home’s purchase price to avoid private mortgage insurance (PMI) and get a better interest rate.

- Shop around: Don’t settle for the first mortgage offer you receive. Shop around and compare rates from multiple lenders to find the best deal.

- Choose a shorter loan term: A 15-year mortgage typically comes with a lower interest rate than a 30-year mortgage. If you can afford the higher monthly payments, consider opting for a shorter loan term.

- Consider paying points: Paying points upfront can help you secure a lower interest rate over the life of your mortgage. Each point typically costs 1% of the total loan amount.

- Be prepared to negotiate: Don’t be afraid to negotiate with your lender to get a better rate. If you have a good credit score and a solid financial history, you may be able to convince them to lower your rate.

JDPDXRealEstate #homebuyer #investment #mortgage #homeowner #JordanMcNackGuildMortgage

Join The Discussion