Paying Down Debt

-

by Jamohl DeWald

by Jamohl DeWald

- December 13, 2023

- Buying Real Estate, First Time Homebuyer

- 0

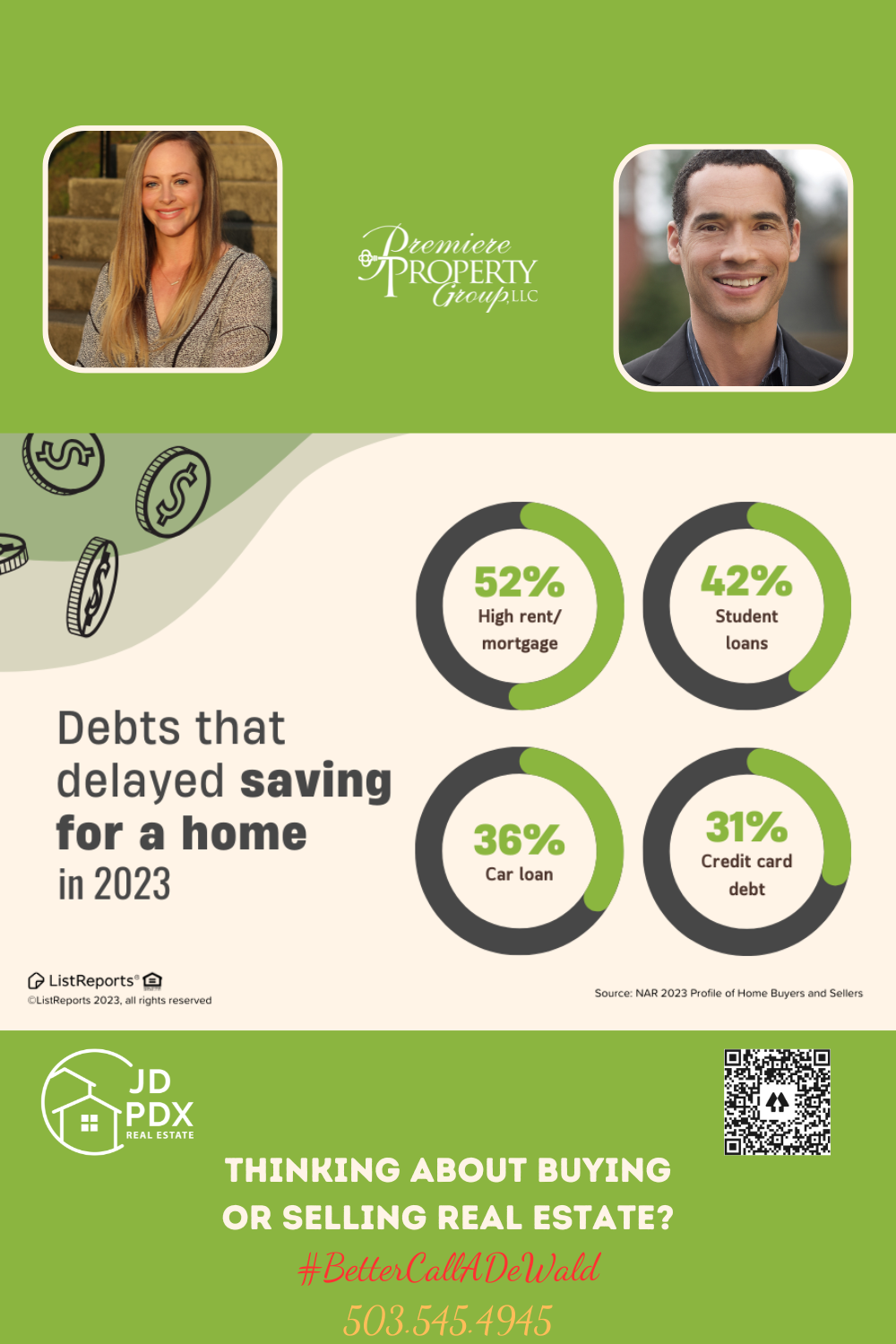

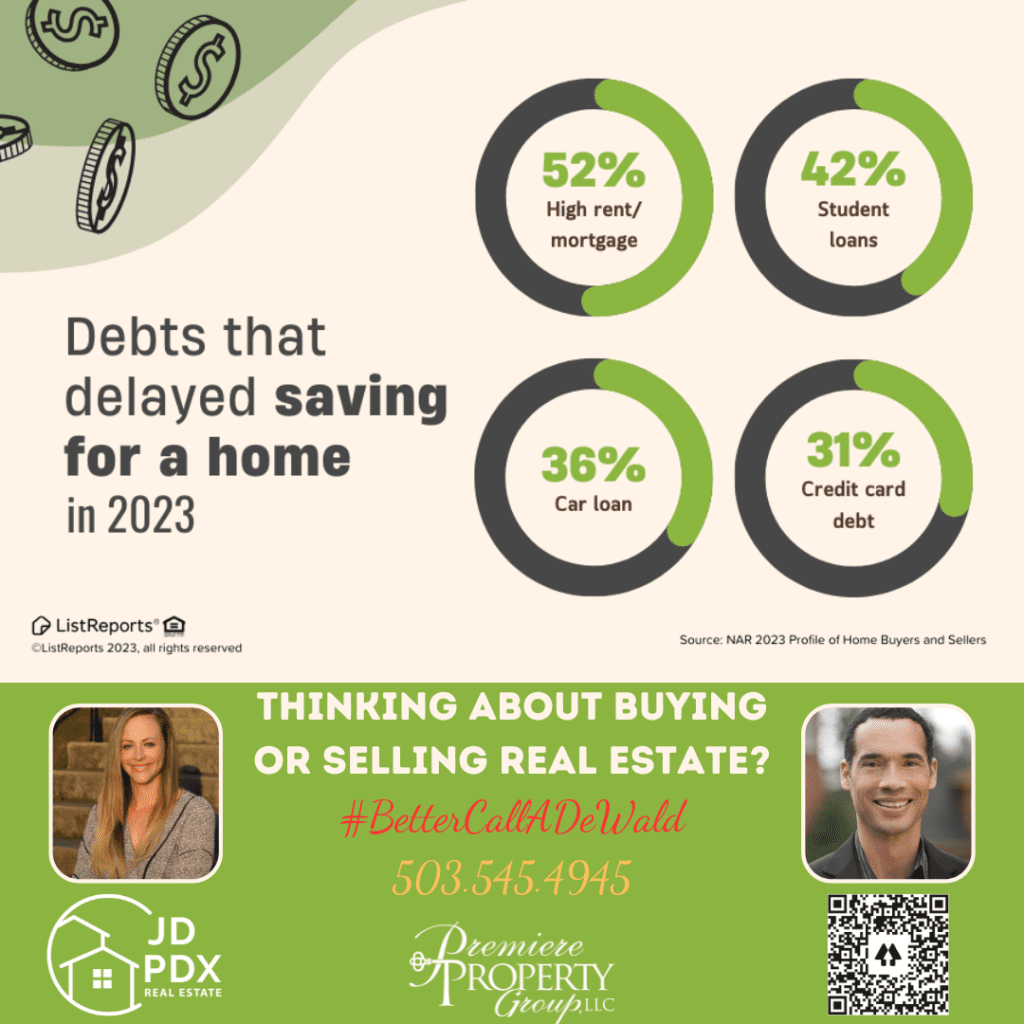

If you struggled to contribute to a home savings fund this year, you are not alone. This year has been incredibly tough for many people, and prioritizing paying down high interest debt is hugely important when it considering purchasing a home and taking on a mortgage. The good news is, there are options available for lower down payments or even zero down. If you’ve got questions about buying (or selling), give us a call or send us a message!

#BetterCallJamohl 503.545.4945

Navigating Home Savings Hurdles: Low Down Payment Solutions

2023 has unfolded as a year of financial challenges, and for many, the dream of a home savings fund has felt just out of reach. If you’ve found it tough to stash away those dollars for a down payment amidst the pressure of high-interest debt, you’re in good company.

Prioritizing debt repayment is a smart strategy, especially when it’s the type that gnaws away at your finances with towering interest rates. Clearing this debt is a crucial step before welcoming the responsibilities of a mortgage.

But here’s a slice of optimism: the housing market has evolved, recognizing the widespread struggle. Today, a variety of programs offer lower down payment options — some even present the possibility of zero down to help lift those barriers to homeownership.

Whether it’s through FHA loans, USDA rural development programs, or VA loans for veterans and service members, these avenues provide a lifeline to potential homebuyers. Coupled with historically low-interest rates, buying a home could be more accessible than you think.

Don’t let a difficult year dampen your home buying hopes. With the right plan and resources, the keys to your new home might just be closer than they appear.

#Homebuyer #firsttimehomebuyer #realestate #realestateagent #JDPDXRealeEstate #homeowner #homeownership #homebuying #homesearch