Pre Qualification VS Pre Approval

While these two terms sound interchangeable, they are very different. Understanding the differences and when to complete each step is essential but can also be confusing. But don’t fret; we can help you every step of the way. Tips below on the differences between pre qualification vs pre approval.

#BetterCallADeWald 503.545.4945

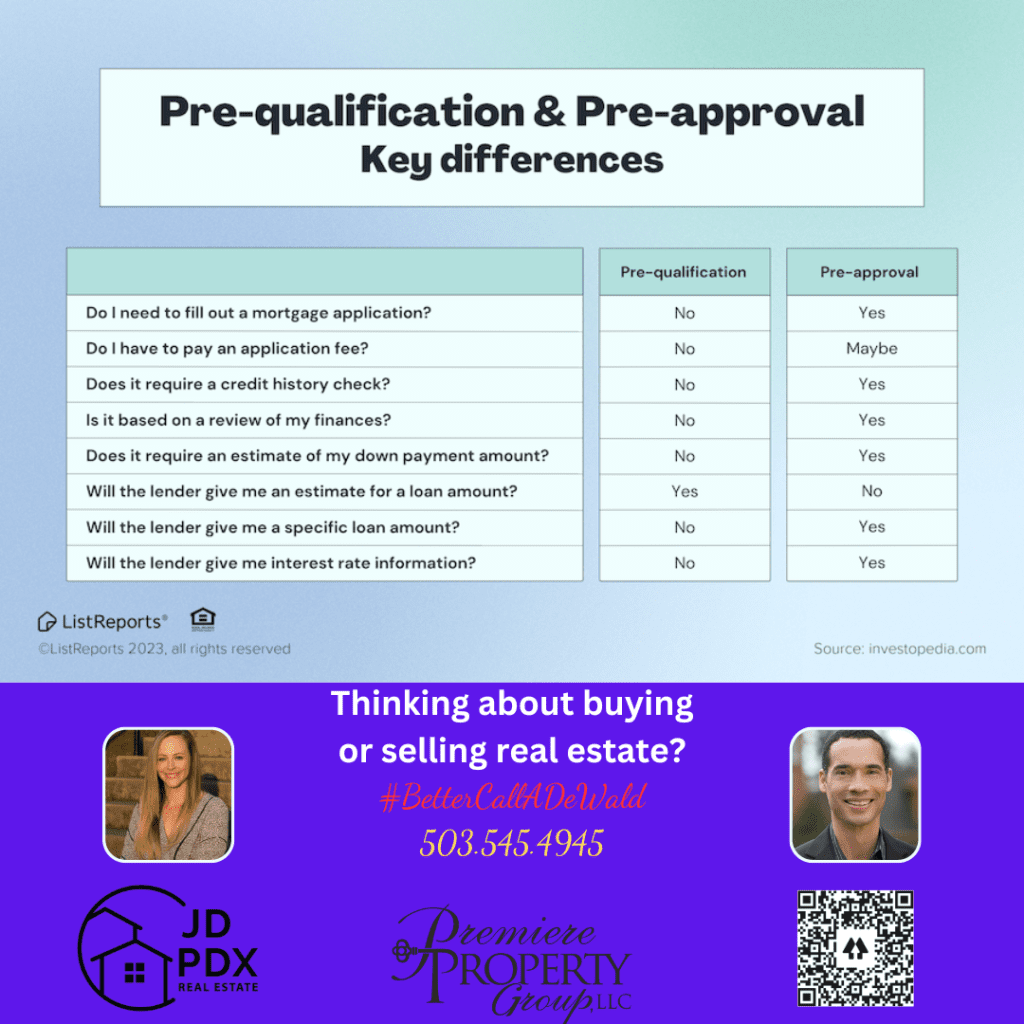

Both pre-qualification and pre-approval are important steps in the mortgage application process. However, there are some key differences between the two:

- Definition: Pre-qualification is an initial evaluation of your financial status and creditworthiness to determine how much you might be able to borrow. Pre-approval, on the other hand, is a more detailed evaluation where a lender reviews your financial documents and credit history to provide a more accurate estimate of the mortgage amount you can afford.

- Information Required: To get pre-qualified, you typically provide your income, debts, and assets, but you don’t need to provide any documentation. To get pre-approved, you’ll need to provide more detailed information about your income, assets, employment history, and credit score. The lender will also need to verify this information by reviewing your financial documents.

- Credit Check: A pre-qualification usually doesn’t involve a credit check, while a pre-approval requires one. This means that a pre-approval may have a temporary impact on your credit score.

- Accuracy: Pre-qualification provides a rough estimate of what you can afford, while pre-approval provides a more accurate estimate since it is based on a more thorough evaluation of your financial status.

- Timeframe: Pre-qualification is a quick and easy process that can often be done online or over the phone, while pre-approval takes more time and effort since it requires you to provide documentation and undergo a credit check.

In summary, pre-qualification provides a rough estimate of how much you may be able to borrow, while pre-approval provides a more accurate estimate and involves a more thorough evaluation of your financial status.

#homebuyer #JDPDXRealEstate #homeowner #realestate #realtor #realestateagent

Join The Discussion