Saving Strategies for First Time Homebuyers

-

by Jamohl DeWald

by Jamohl DeWald

- September 27, 2023

- Buying Real Estate, First Time Homebuyer

- 0

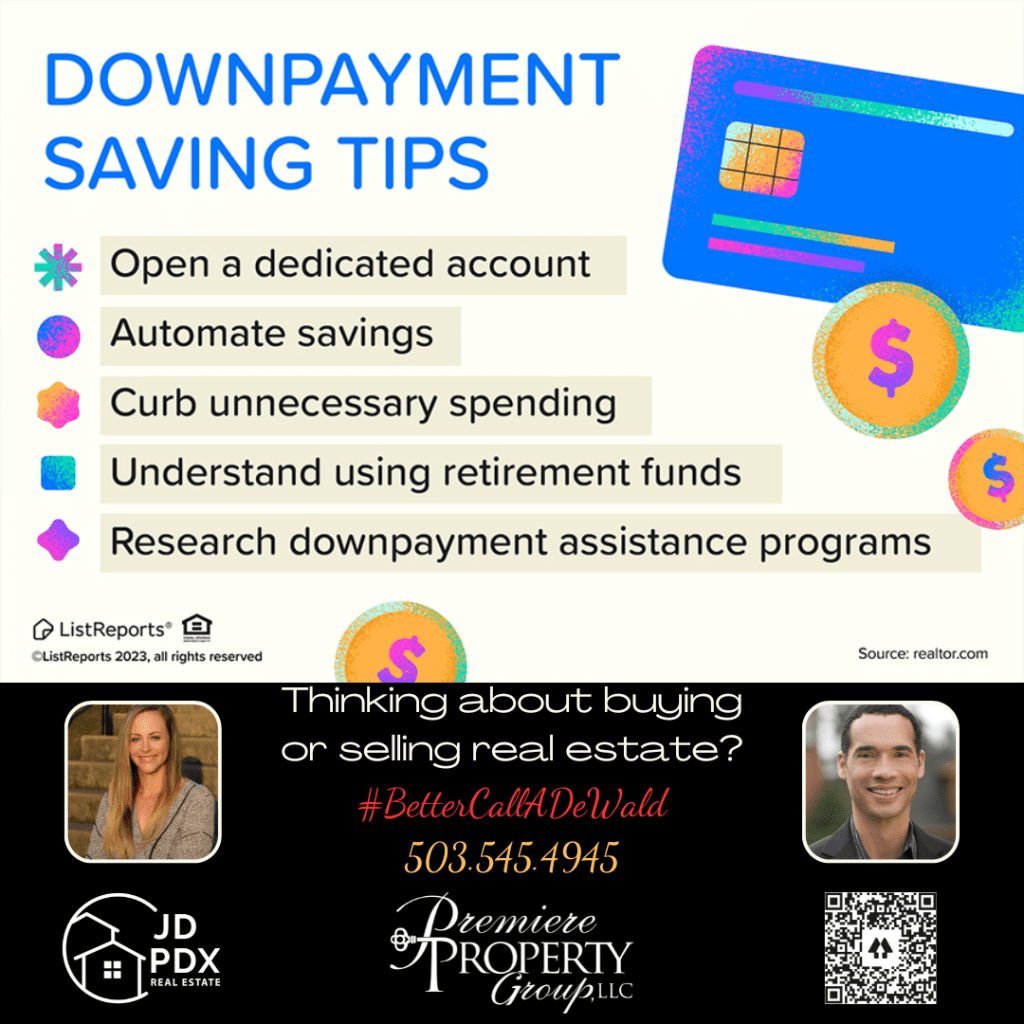

Dreaming of owning a home? Check out these savvy down payment savings tips, and when you’re ready to take the next step, reach out. We’re here to guide you on your journey to a new home. Below we go over some saving strategies for first time homebuyers.

#BetterCallADeWald 503.545.4945

Are you a first-time homebuyer looking to turn your dream of homeownership into a reality? One of the most critical steps in this journey is saving for a down payment. To help you achieve your goal, we’ve compiled some savvy saving tips that will not only boost your bank account but also get you closer to that front door key.

Building Your Downpayment:

- Budget Wisely: Start by creating a detailed budget that tracks your income and expenses. Identify areas where you can cut back and allocate those savings towards your down payment fund.

- Automate Savings: Set up automatic transfers to a dedicated savings account. This “out of sight, out of mind” approach ensures you consistently save without temptation.

- Side Hustles: Consider taking on a side gig or freelancing to earn extra income specifically for your down payment fund.

- Cut Unnecessary Costs: Review your monthly subscriptions and eliminate any you don’t use regularly. Redirect that money towards savings.

- Windfalls and Bonuses: Whenever you receive unexpected money, like tax refunds or work bonuses, put a significant portion into your down payment fund.

- Downsize Temporarily: While saving, consider downsizing your living situation or renting a more affordable space temporarily to free up more funds for your down payment.

- Explore First-Time Buyer Programs: Research government programs or grants that may provide assistance for first-time homebuyers.

- Shop Smart: When purchasing items, look for deals and discounts. The money you save can be added to your down payment fund.

Remember, the journey to homeownership is a marathon, not a sprint. With discipline and these saving strategies, you’ll be well on your way to securing the down payment you need to buy your first home.

#FirstTimeHomebuyer #JDPDXRealEstate #homebuyer #realestate #realestateagent #realtor #homeowner