Smart Moves to Make Before You Buy a Home

Getting ready to buy a home starts long before you fill out a loan application. Small actions—like monitoring your credit, setting aside extra savings, and keeping big purchases on pause—can make a big difference when it’s time to apply. We’re here to guide you through each step so you feel confident and prepared. Have questions about where to begin? Send us a message and let’s build your game plan today!

#BetterCallJamohl 503.545.4945

Smart Moves to Make Before You Buy a Home

Getting ready to buy a home starts long before you sit down with a lender or tour your first property. By making a few smart moves early on, you can set yourself up for a smoother, more successful homebuying experience.

One of the most important steps is keeping an eye on your credit. Your credit score plays a big role in the type of loan you qualify for and the interest rate you’ll receive. Monitoring your credit and addressing any errors or issues can put you in a stronger position.

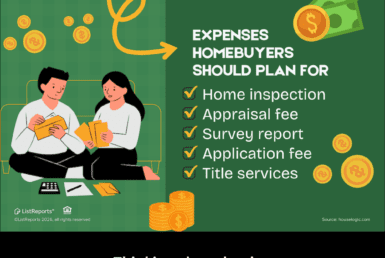

Next, focus on building up your savings. Beyond your down payment, you’ll want to have funds set aside for closing costs and moving expenses. Even small, consistent contributions to your savings account can make a big difference when the time comes.

It’s also smart to hold off on making big purchases. Major buys, like a new car or expensive furniture, can affect your debt-to-income ratio and potentially impact your loan approval.

The good news? You don’t have to navigate these steps alone. We’re here to guide you through the process, answer your questions, and connect you with trusted professionals who can help.

Ready to create your game plan for homeownership? Send us a message today—we’ll help you prepare with confidence!

#Homebuyer #JDPDXRealEstate #househunting #realestate #realtor #realestateagent #dreamhome

Join The Discussion