Steps to Becoming a Homeowner

-

by Jamohl DeWald

by Jamohl DeWald

- May 16, 2023

- Buying Real Estate, Mortgage, Real Estate

- 0

Starting the process by “just browsing” could set you up for heartbreak. Before you go looking for (and falling in love with) a home, you need a realistic idea of what you can afford, make sure your credit is in good shape, and, most importantly, get pre-approved for a mortgage. If you’re unsure where to start, you’re in luck! We know some of the best loan officers around, and working with us means our connections are your connections! Below are some steps to becoming a homeowner.

#BetterCallADeWald 503.545.4945

To get in the best position to buy a home, there are several key steps you should take.

First, assess your financial situation by determining how much you can afford to spend on a home and saving for a down payment. Saving at least 20% of the home’s purchase price will help you avoid private mortgage insurance. There are programs out there that allow you to put as little as 3.5% down.

Next, focus on improving your credit score. Pay your bills on time, reduce existing debts, and avoid opening new lines of credit. A higher credit score will make you more attractive to lenders and enable you to secure a mortgage with better terms.

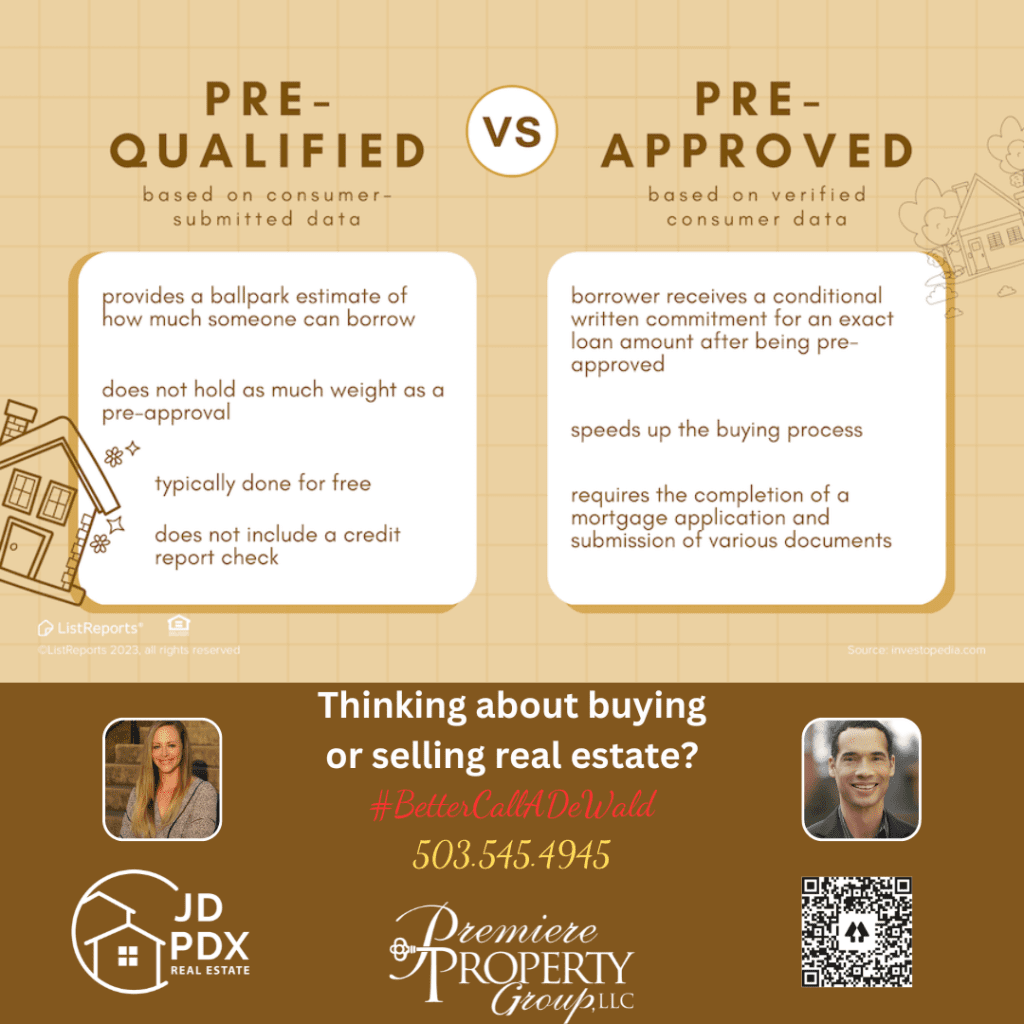

Obtaining pre-approval for a mortgage is crucial. It involves providing your financial information to a lender who will assess your creditworthiness and give you an estimate of how much you can borrow. Pre-approval strengthens your position when making an offer and shows sellers that you are a serious buyer.

Research the real estate market in your desired area and set priorities for the type of home and features you want. Work with a qualified real estate agent who has expertise in the local market to guide you through the process and negotiate on your behalf.

Once you find a potential home, conduct thorough inspections to identify any hidden issues. Make a competitive offer based on the home’s value and market conditions.

Finally, secure financing by working closely with your lender, providing necessary documentation, and completing any required steps. Attend the closing meeting, review all documents carefully, and finalize the purchase.

Taking these steps will help you position yourself effectively to buy a home and make informed decisions throughout the process.

#JDPDXRealEstate #homebuyer #realestate #realtor #realestateagent #mortgage #investment #homeowner #WeGotAGuy

Join The Discussion