Things All Homebuyers Absolutely Need To Know About The Market

-

by Jamohl DeWald

by Jamohl DeWald

- December 12, 2018

- Buying Real Estate, Real Estate Investment

- 0

Things All Home buyers Absolutely Need To Know About the Market

Buying a new home can be an exciting time. It can also be frustrating, stressful and exhausting. To help prepare you for home hunting success, here are five important things home buyers should know about the market before visiting their first open house.

1) Is it a buyer’s market or seller’s market? And what’s the difference?

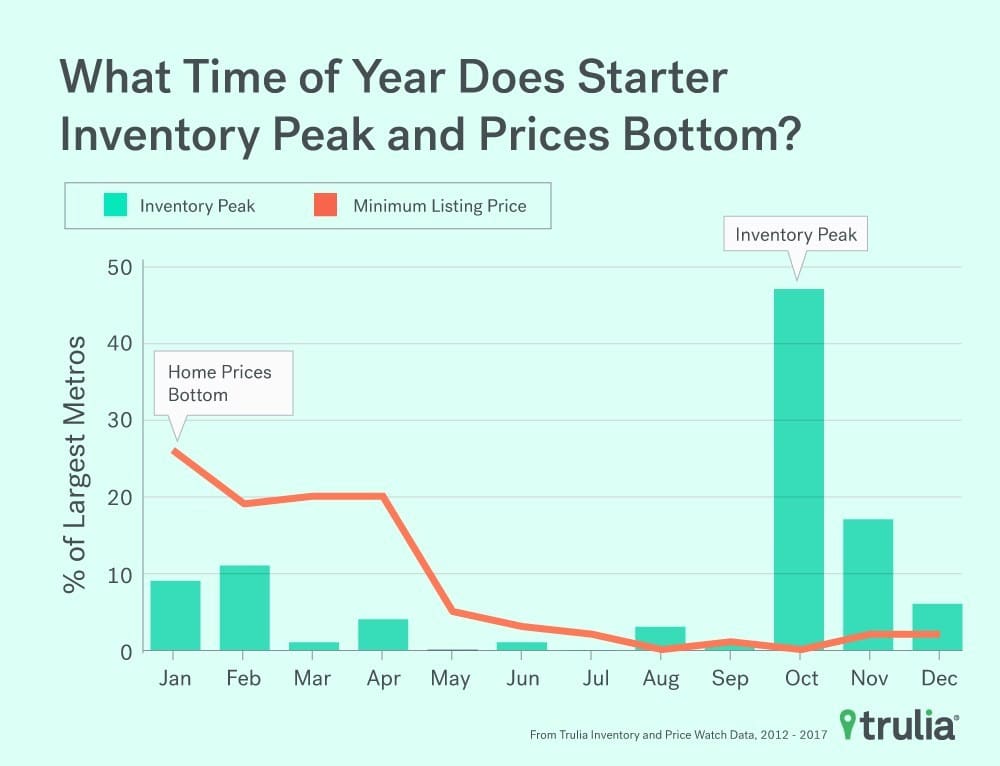

Most markets are governed by the law of supply and demand, the housing market is no exception. When demand (buyers shopping for homes) is high and supply (homes for sale) is low, prices go up, and multiple offers can be common. On the flip side, when demand is low and supply is high, prices go down. As home inventories rise, so does the competition amongst sellers, which drives prices down.

In a buyer’s market, sellers have more flexibility with the selling price, which is good news for buyers. In a seller’s market, there aren’t enough homes available to support the high demand. Homes sell fast, and often at premium prices.

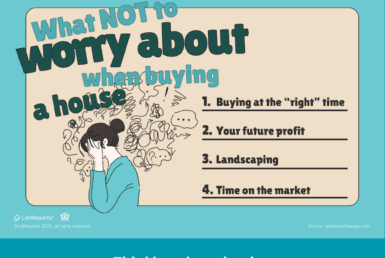

Like any other market, the real estate market goes in cycles. Periods of depreciation are then followed by periods of appreciation. If you study the market, you can attempt to predict trends, and try to time the purchase of your new home accordingly.

2) Analyze local pricing trends

Start by doing some initial online searches in the communities you’d like to live in to see what homes are selling for in these areas and what they’ve been selling for over time. Then, check neighboring cities and compare where the prices might be accelerating or depreciating faster than the other. In areas where you see higher average home prices, this is also where you’ll find the most demand. As you get familiar with local pricing trends, you’ll be able to quickly spot good prices, and overpriced homes based on the home features, location, and amenities.

3) Research up-and-coming areas

Broaden your market research and look to neighboring cities. A key indicator of a soon-to-be hot city is the development of new infrastructure. New businesses, shopping centers, roads, and schools are all positive signs that an area is getting ready to grow. Being an early buyer in an up-and-coming market might turn into significant appreciation down the road.

4) Review School Rankings

Schools in each state are ranked by how well kids perform on math and English tests. Even if children aren’t in your future, this could be very important to a future buyer with school-aged kids in a few years if you decide to sell your home. Compare the school scores for neighboring cities as well, and even the rankings for several schools within Portland metro area. Searching for a home just a few streets over could put your home in a more desirable school.

5) Explore neighborhood demographics

Take a close look at the homes you’re considering in each market and determine the percentage of renters and owner-occupied homes. If you’re thinking about a home in an area where people are mainly renting, it can only take a few bad renters or property owners to set the neighborhood off on a downturn. What’s the average age of the people in the areas you’re exploring? If a town is full of young singles, or college students, will this also be a good place to raise children? Or, if you have young children, are there other children in the neighborhood?

Purchasing a home will likely be the biggest financial decision of your life. If you need any assistance guiding you through the process, please reach out!

More Helpful Advice

8 First Time Home Buyer Mistakes to Avoid – Via Sharon Paxson

Buying A Home In A Seller’s Market, Your Survival Guide -Via Joe Boylan

9 Critical Questions To Ask When Buying A Condo – Via Conor MacEvilly

How To Budget When Buying A Home – Via Eileen Anderson

9 Shocking Facts Home Buyer’s Don’t Know – Via Michelle Gibson

13 First Time Home Buyer Mistakes To Avoid -Via Luke Skar

How To Find Your Forever Home – Via Anita Clark

What is Dual Agency: Why Buyers And Sellers Should Avoid it – Via Bill Gassett

10 Killer Tips for Buyers in a Seller’s Market -Via Petra Norris

10 Biggest Mortgage Mistakes First-Time Home Buyers Make – Via Xavier De Buck

About Jamohl

My philosophy is simple, clients come first. I pledge to be in constant communication with my clients, keeping them fully informed throughout the entire buying or selling process. If you’re not left with an amazing experience, I haven’t done my job. Success is not measured through achievements or awards but through the satisfaction and repeat/referral business of my clients. My goal is to be your top realtor choice when it comes to buying or selling real estate. Having spent most of my life in Portland, OR., living in Northeast, Southeast, Bethany, Hillsboro, Beaverton, downtown, St. Johns, Clackamas and West Linn, I’m very knowledgeable of the many different neighborhoods our city has to offer.

Join The Discussion