Tips to Help You Repair Your Credit

Your credit score helps lenders see how you’ve handled debt in the past; the higher your score, the lower the interest rate on your mortgage might be. So, as you can imagine, it’s good to raise your score in preparation for applying for a loan.

#BetterCallJamohl 503.545.4945

Tips to Help You Repair Your Credit

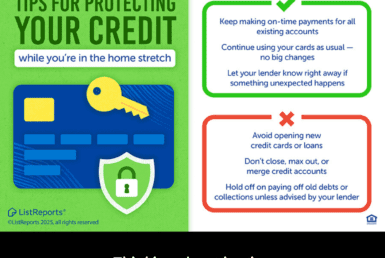

Your credit score plays a major role in your financial journey—especially when it comes to buying a home. Lenders look at your score to determine how you’ve managed debt in the past, and the higher your score, the better the mortgage rates you may qualify for. That means improving your credit score now can pay off big when you’re ready to apply for a loan.

The good news? Repairing your credit doesn’t have to feel overwhelming. Start by staying on top of your credit report and checking it regularly for errors. If you notice mistakes, dispute them right away—correcting even small issues can make a difference. Next, be diligent about paying your bills on time, every time, since late payments can drag down your score.

It’s also smart to keep your credit card usage under 30% of your available limit and focus on paying down outstanding debts. Resist the urge to close old accounts; those can help build a longer credit history. Finally, avoid applying for too many new lines of credit at once, as multiple inquiries can lower your score.

With consistent effort, you’ll see steady improvements. Remember, credit repair is about progress, not perfection—and every positive step brings you closer to your dream of homeownership.

#Homebuyer #JDPDXRealEstate #homeowner #finances #financetips #investment #realestate #realtor #realestateagent

Join The Discussion