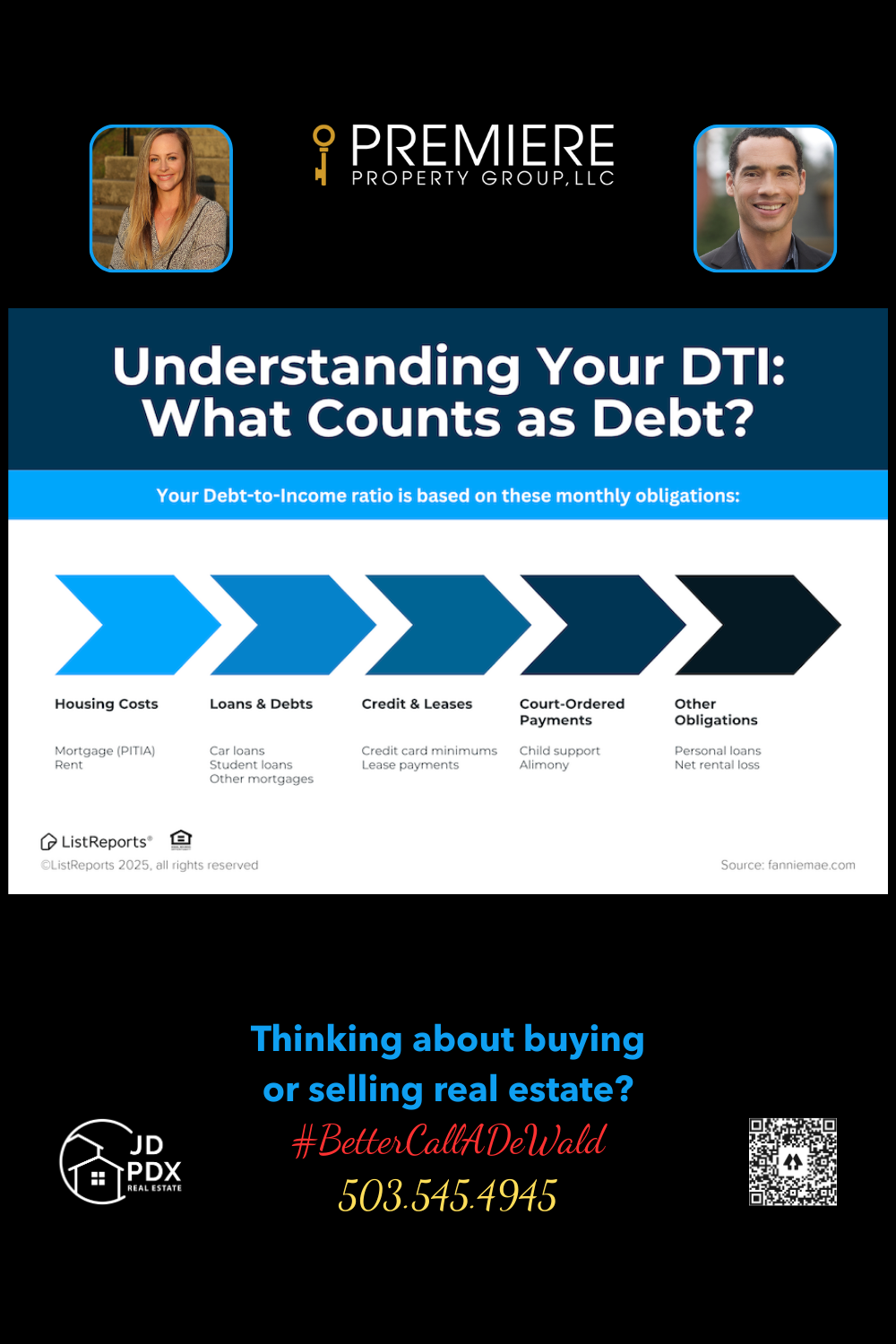

Understanding Your DTI

Your debt-to-income ratio (DTI) plays a big role in how much home you can qualify for. Understanding what counts as debt—and how it affects your buying power—can make the home search process smoother and less stressful. We can connect you with trusted lenders who will break it down for you and help you prepare. Ready to take the first step toward your dream home? Let’s chat!

#BetterCallJamohl 503.545.4945

Understanding Your DTI

Your debt-to-income ratio (DTI) plays a big role in how much home you can qualify for—and understanding it can help you feel more confident as you begin your buying journey.

Put simply, DTI compares your monthly debt payments to your gross monthly income. Lenders use this number to measure how much of your income is already committed to existing obligations. Things like mortgage or rent, car loans, student loans, credit card minimums, alimony, and personal loans are all included. The lower your DTI, the more room you may have in your budget for a mortgage payment, which can increase your buying power.

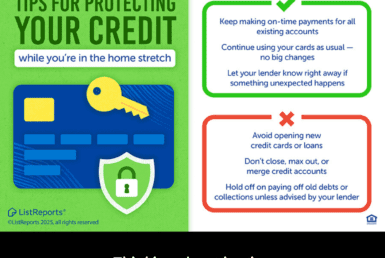

While the math might sound overwhelming, don’t worry—you don’t have to figure it all out alone. We work closely with trusted lenders who can walk you through your DTI, explain what counts toward it, and help you create a plan to improve it if needed. Small steps, like paying down high-interest credit cards or avoiding new debt before applying, can make a meaningful difference.

Buying a home is one of the biggest financial decisions you’ll ever make, and the right guidance can take away a lot of stress. Let’s connect and take the first step toward finding your dream home together.

#JDPDXRealEstate #finances #investment #realestate #realtor #realestateagent #newhome #dreamhome

Join The Discussion