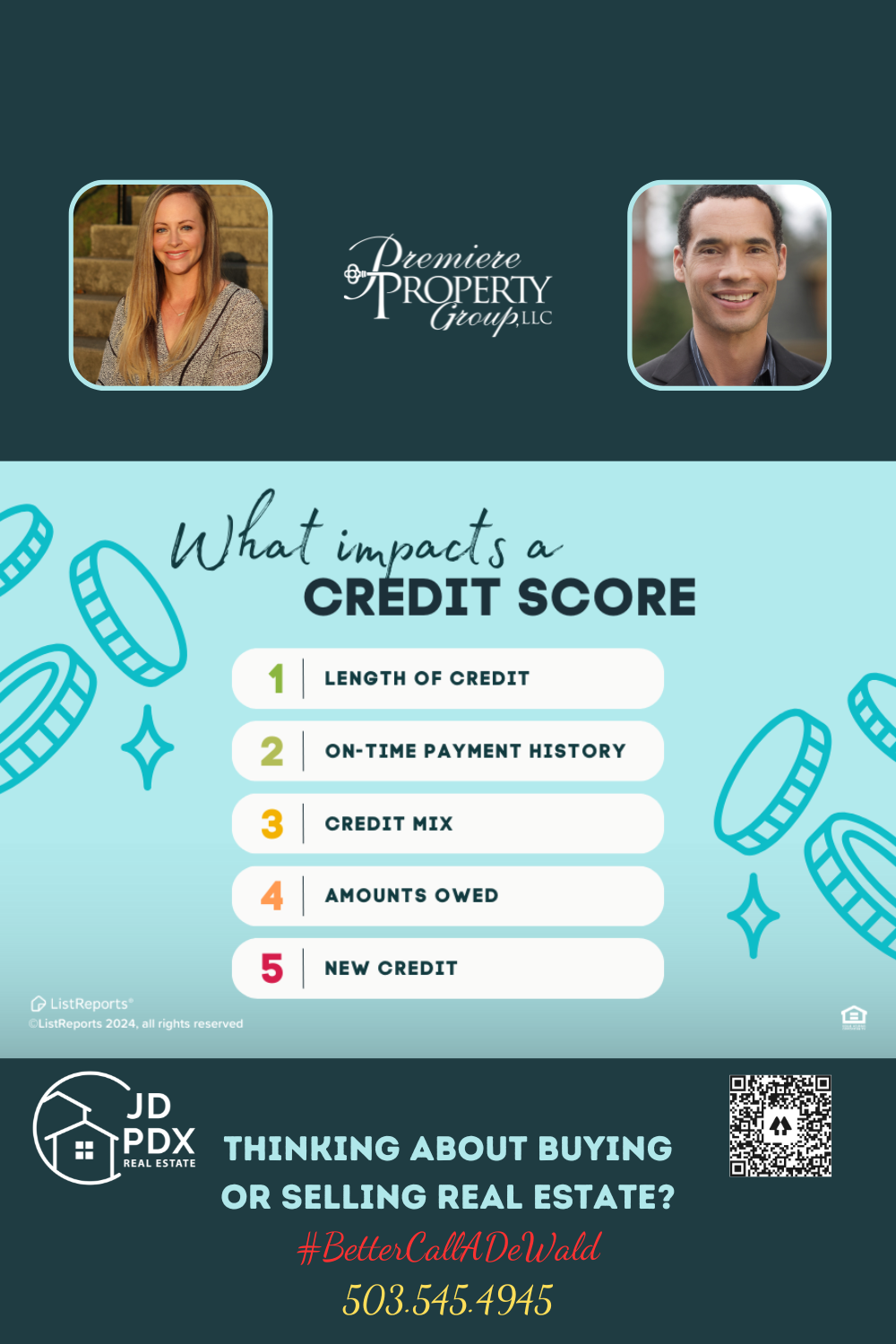

What Impacts a Credit Score

Your credit score is more than just a number; it’s the key that opens doors to mortgage approval and favorable interest rates. Whether you’re aiming for a cozy starter home or eyeing a luxurious estate, building a healthy credit score demonstrates creditworthiness and increases your approval odds for certain credit cards, car loans, mortgages and more. If you’re ready to buy a home, send us a message and let’s chat!

#BetterCallJamohl 503.545.4945

Unlocking the Mysteries of Your Credit Score: Key Factors & Strategies for Improvement

Understanding what impacts a credit score is crucial for anyone aiming to navigate the financial landscape effectively. A credit score isn’t just a number—it’s a snapshot of your financial health and a critical factor in securing loans and favorable interest rates.

Key Factors Influencing Your Credit Score:

- Payment History (35%): Consistently making payments on time is the most significant factor. Late payments can severely dent your score.

- Credit Utilization (30%): How much credit you’re using versus your available credit limit. Aim to keep this ratio below 30% for a healthy score.

- Length of Credit History (15%): Longer credit histories provide more data points, contributing to a higher score.

- New Credit (10%): Opening several new accounts in a short period can lower your score.

- Credit Mix (10%): A mix of credit types (credit cards, mortgages, car loans) can positively affect your score.

Strategies for Improvement:

- Pay on Time: Set reminders or autopay to ensure timely payments.

- Reduce Debt: Focus on lowering your credit utilization ratio.

- Avoid Unnecessary Credit: Apply for new credit only when needed.

- Regularly Monitor Your Credit: Check your credit report for errors and address them promptly.

Improving your credit score is a journey, not a sprint. By focusing on these key aspects, you’re not just improving a number—you’re building a stronger financial future.

#realestate #realestateagent #JDPDXRealEstate #homeowner #dreamhome #homeownership #homebuying #homesearch #buyingahome