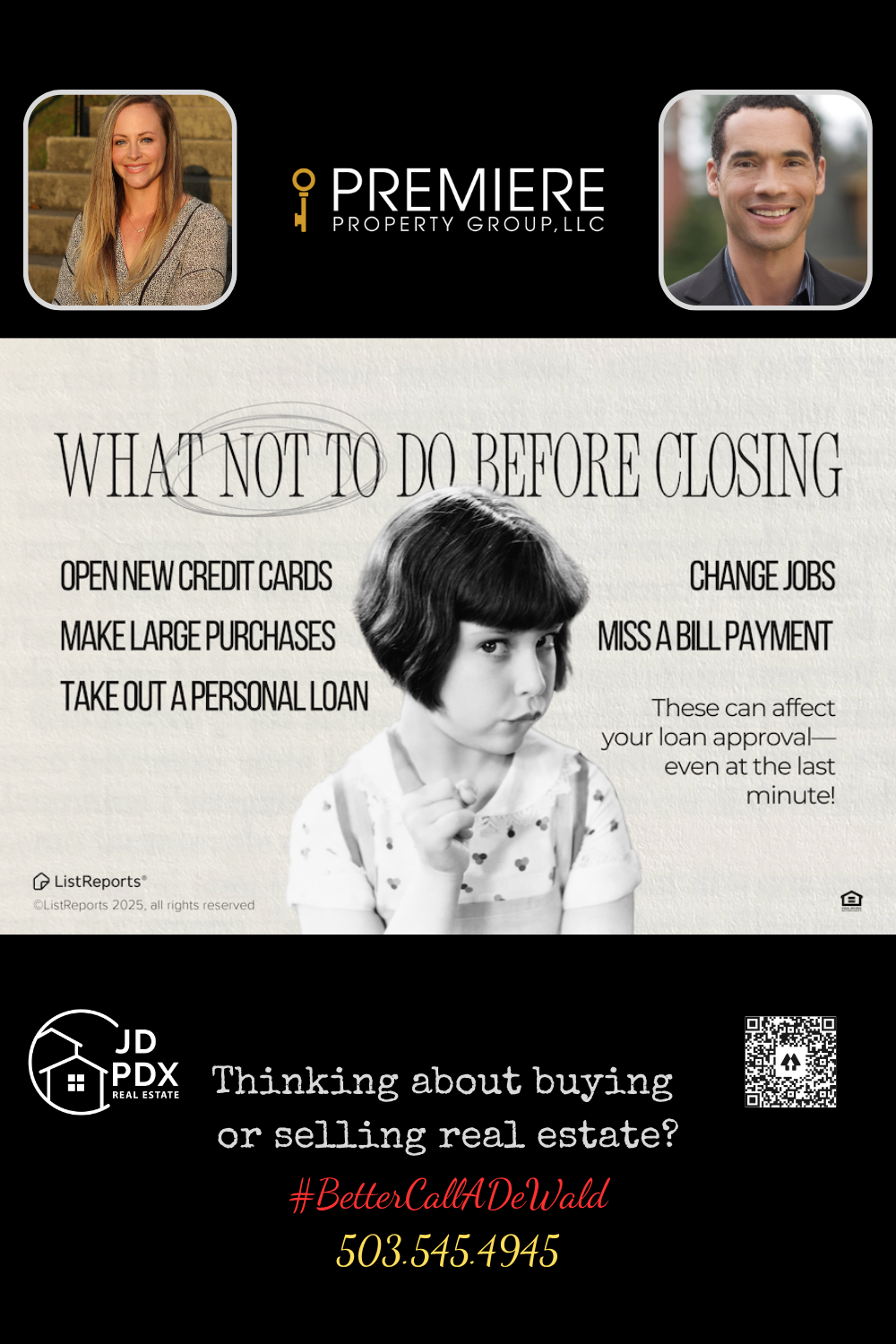

What Not To Do Before Closing

Certain financial moves can put your loan approval at risk, even right before closing. That’s why we always remind our buyers to check in before opening a new credit card or making a big purchase. Have questions? We’re just a message away and happy to connect you with a great loan officer too!

#BetterCallJamohl 503.545.4945

You’ve found the perfect home, your offer is accepted, and you’re almost to the finish line—closing day! But before you start shopping for new furniture or celebrating with a big purchase, let’s hit pause for a quick reality check. Certain financial decisions can put your mortgage loan approval at risk, even just days before closing.

Lenders do a final check on your credit, income, and debts before funding your loan. That means opening a new credit card, taking out a personal loan, making a large purchase (yes, even a fridge), switching jobs, or missing a bill payment could delay or even derail your closing. And we definitely don’t want that.

That’s why we always encourage our clients to check in with us—or their loan officer—before making any big financial moves. Buying a home should be exciting, not stressful, and we’re here to make sure your path to the front door stays smooth.

Have questions about what’s safe (and what’s not) before closing? Don’t guess—reach out! We’re just a message away and always happy to connect you with trusted lenders and helpful resources.

#HomeBuyingTips #ClosingDayChecklist #BetterCallADeWald #FirstTimeBuyerHelp

#homebuyer #JDPDXRealEstate #househunting #investmen #realestate #realtor #realestateagent #dreamhome

Join The Discussion