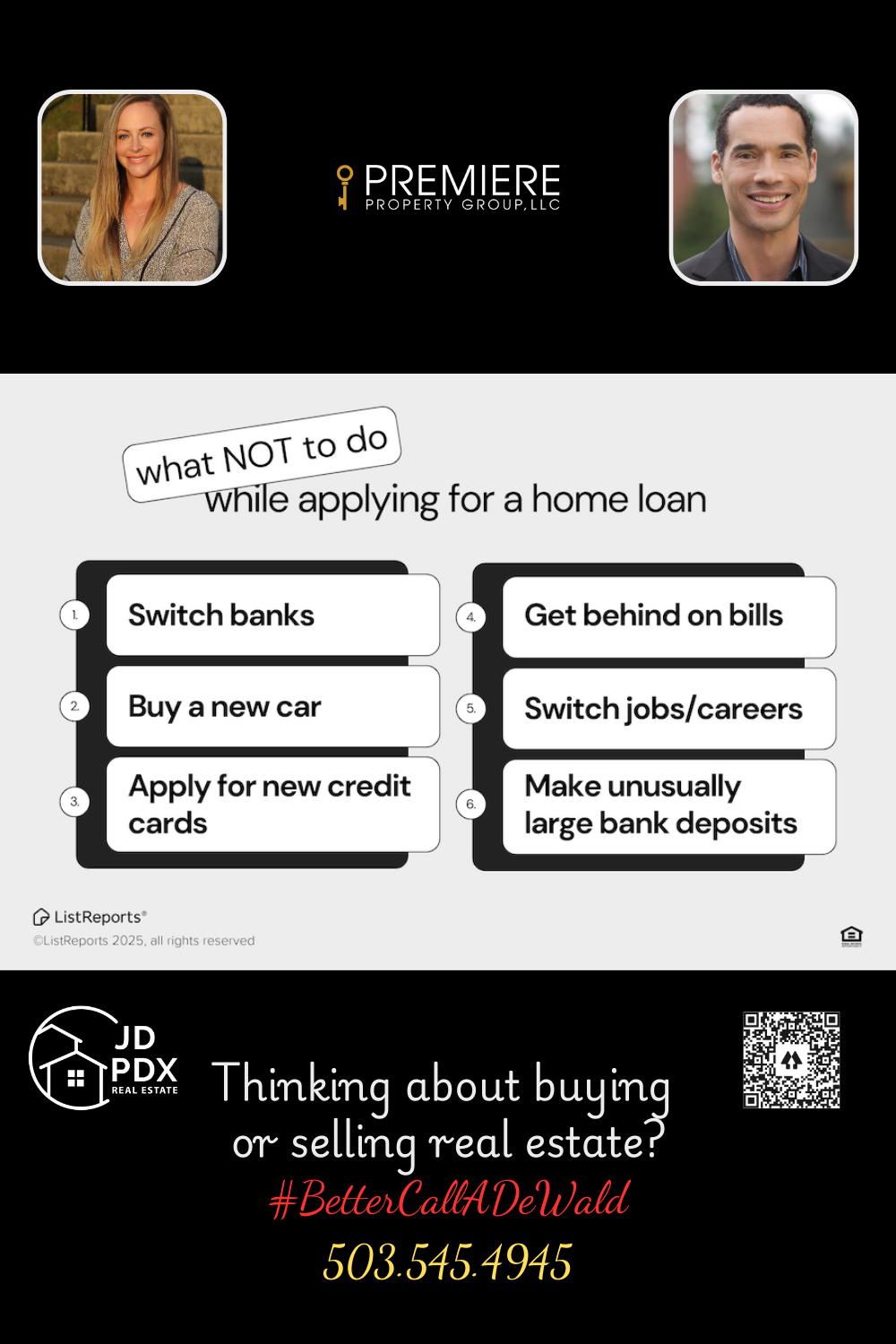

What NOT to do When Purchasing a Home

When you’re on the path to homeownership, staying financially steady is key! Big changes like switching jobs or making large purchases can slow down the process—and nobody wants that. A smooth loan approval starts with careful planning. Have questions about navigating the do’s and don’ts? We’re here to guide you every step of the way! ?

#BetterCallJamohl 503.545.4945

What NOT to Do When Purchasing a Home

Buying a home is an exciting journey, but did you know that certain financial moves can put your purchase at risk? To keep your loan approval on track and ensure a smooth closing, here are key mistakes to avoid when purchasing a home.

? Switching Jobs – Lenders want stability. Changing careers or quitting your job before closing can disrupt your mortgage approval. If a change is necessary, talk to your lender first.

? Making Large Purchases – That new car, furniture set, or lavish vacation might be tempting, but big expenses can impact your debt-to-income ratio and delay loan approval. Wait until after closing to splurge!

? Opening or Closing Credit Accounts – Applying for new credit cards or loans can lower your credit score. Similarly, closing old accounts may alter your credit utilization. Keep things steady!

? Making Large Bank Deposits – Unexplained cash deposits can raise red flags for lenders. If you receive a large sum, document where it came from and discuss it with your lender.

A smooth home-buying process starts with careful financial planning. Have questions? We’re here to guide you every step of the way! Let’s make your dream home a reality—without the hiccups!

#Homebuyer #JDPDXRealEstate #homeowner #investment #realestate #realtor #realestateagent #dreamhome

Join The Discussion