Why Skipping Pre-Qualification for Pre-Approval is Your Best Move

While these two terms sound interchangeable, they are very different. Understanding the differences and when to complete each step is essential but can also be confusing. But don’t fret; we can help you every step of the way. We’re only a message away! Below, we share why skipping pre-qualification for pre-approval is your best move.

#BetterCallJamohl 503.545.4945

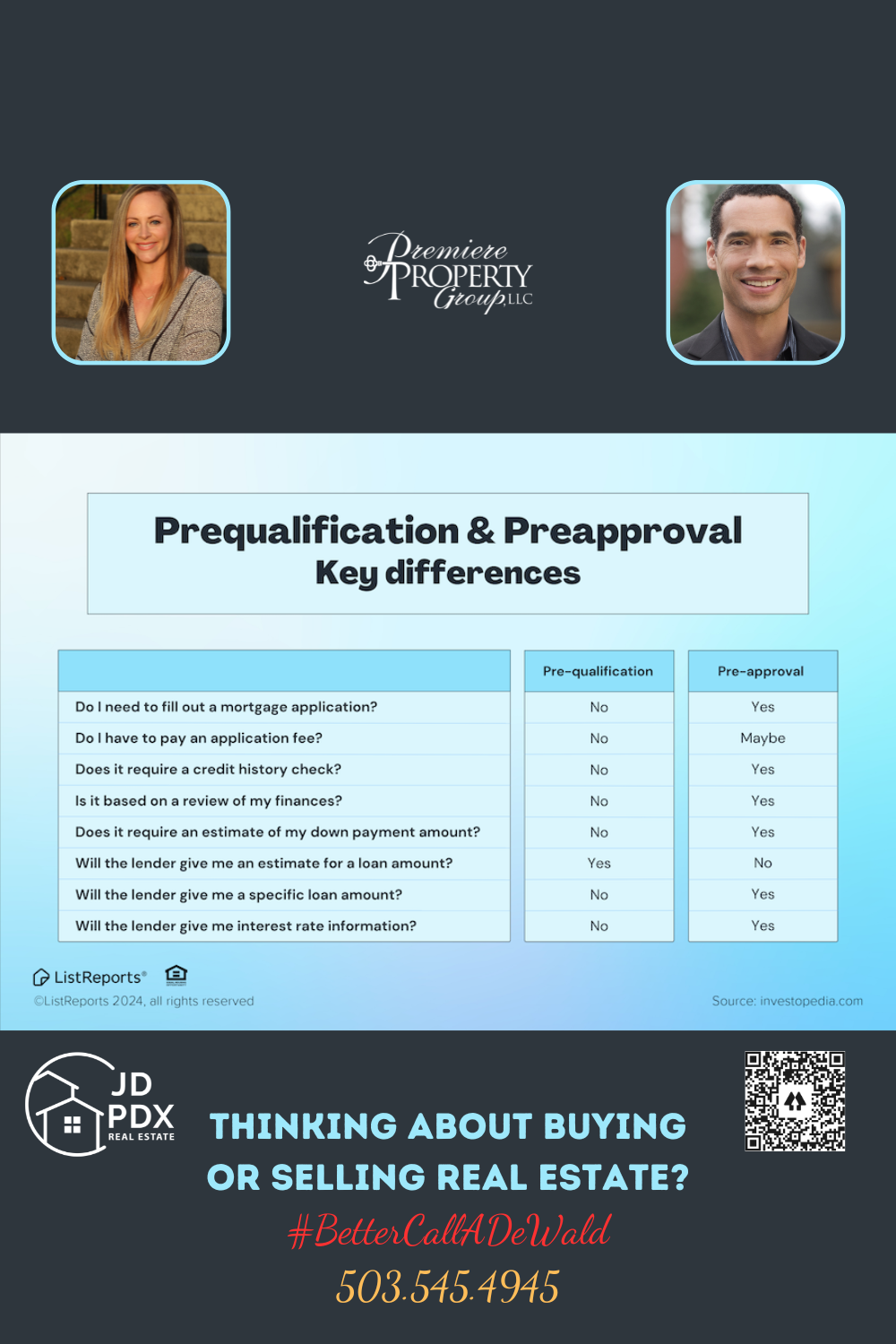

In the world of home buying, “pre-approval” and “pre-qualification” often buzz around, seemingly interchangeable. Yet, they stand poles apart, and discerning their differences is crucial for any aspiring homeowner. A pre-qualification is your first step—a casual glance at your financial standing, giving a ballpark figure of what you might afford. It’s quick, often done over the phone or online, and doesn’t require a deep dive into your financial history.

However, when the game gets serious, pre-approval steps into the spotlight. This is where lenders take a closer look, scrutinizing your financial health with a fine-tooth comb. They’ll check your credit, verify your income, and confirm your assets. Why does this matter? A pre-approval letter is your golden ticket in the home buying process. It not only gives you a precise budget but also elevates your standing in the eyes of sellers. They’ll see you as a committed buyer, with the backing of a lender to complete the purchase.

Skipping straight to pre-approval can save you from the heartbreak of falling in love with homes out of your budget and strengthens your offer in competitive markets. So, while pre-qualification might be the first step, pre-approval is where the journey truly begins, setting the stage for a smoother, more assured path to homeownership.

#JDPDXRealEstate #homeowner #happyhomeowner #realestate #realtor #realestateagent #firsttimehomebuyer