You Need to Know Differences Between Conventional FHA and VA Loan

Conventional FHA VA Loans

Conventional FHA VA loans – Are you scratching your head trying to figure out which type of mortgage is going to best suit your needs in Portland Metro Area? For most borrowers, there are three major loan types: Conventional, Federal Housing Administration (FHA), and Veterans Affairs (VA). Here is some information on all three to help you decide which loan is perfect for you. You will definitely want to shop around for the best rates for your situation by checking with your bank and a couple different mortgage brokers.

Conventional Loans

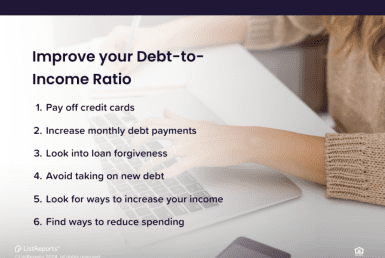

Conventional FHA VA loans – If you have great credit, a conventional loan could be your best bet and qualify you for the most competitive interest rate. If you have a credit score in the 700s, have a down payment of 5 to 20%, and have a low (less than 40%) debt-to-income ratio (the percentage of your monthly income allocated to debt, such as mortgages, credit card payments, or other loans).

With a conventional mortgage, you’ll have fewer barriers to break down and can usually obtain one quicker than an FHA or VA loan.

In addition to having a down payment, you will also likely need to have the cash to cover closing costs, lender fees, and mortgage insurance if you don’t meet the minimum down payment requirement.

1st Time Home Buyer Programs

Federal Housing Administration FHA Loans

Conventional FHA VA loans – If you have a low credit score (lower than 600), a small down payment of around 3.5%, or if your mortgage payments will account for a significant portion of your paycheck, an FHA loan may offer you some flexibility.

The key differentiator with FHA loans is that the FHA provides insured mortgages, and doesn’t actually lend money. As a borrower, you could be eligible to spend up to 57% of your total income on monthly debt obligations; such as your mortgage, auto loans, child support, and credit card payments.

The flexibility of FHA mortgages has some associated costs; 1.75% of the loan amount is due at closing, along with an annual fee, around 0.8%. If your financial situation improves or if you build equity in your home, the only way to eliminate these FHA fees is to refinance.

Veterans Affairs VA Loans

Conventional FHA VA loans – If you or a qualifying family member is active in the military, or a veteran, you could qualify for a VA mortgage with 100% financing. If you’re the spouse of a military member who passed away while on active duty, you could also apply. There’s no need to be a first-time buyer so that you can get a VA loan in the future as well. There’s also no limit to how much you can borrow with a VA loan, but there are limits that may affect you based on your state and county, and how much of a financial responsibility you can handle.

A fundamental difference with VA loans is that the VA doesn’t lend money, it backs the loans made by private lending institutions. You may still need cash for an earnest-money deposit, and closing costs. A seller is allowed to cover the closing costs, but it’s not required. Additionally, if you’re securing a VA loan for a primary residence, you won’t require a down payment, but there’s a cost of 2.15 to 3.3% that you (or the seller) will need to pay in advance. The good news is this fee can be rolled into the mortgage.

Not sure which type of loan you should apply for? I deal with all types of home buyers. If you have a question, please get in touch with me.

More Posts you may be interested in:

Join The Discussion