Your DTI: The Secret Behind Every Mortgage Approval

When it comes to buying a home, lenders look more closely at your income than your assets. That’s why your debt-to-income (DTI) ratio matters—it shows how comfortably you can manage a mortgage payment. A strong DTI can make all the difference in getting approved. Need a trusted lender who can walk you through it? We can connect you!

#BetterCallJamohl 503.545.4945

Your DTI: The Secret Behind Every Mortgage Approval ?

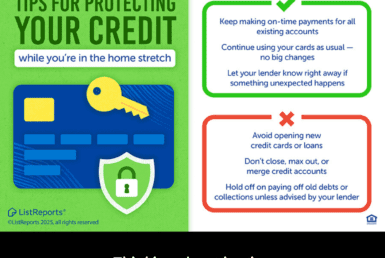

When it comes to buying a home, lenders aren’t just looking at how much you’ve saved—they’re focusing on how much you earn compared to what you owe. That’s where your Debt-to-Income (DTI) ratio comes in. It’s the secret ingredient that helps lenders understand your financial balance and determine how comfortably you can take on a mortgage.

A lower DTI ratio shows that your income can easily handle your current debts plus a new home loan, making you a stronger, more confident buyer. On the flip side, if your DTI is a bit high, don’t stress—it just means it might be time to fine-tune your budget or work with a trusted professional to improve your numbers before applying.

At JD PDX Real Estate, we know that every buyer’s financial story is unique. That’s why we collaborate with trusted local lenders who can help you understand your DTI, guide you through the approval process, and set you up for long-term success.

Whether you’re just starting your home search or preparing to make an offer, we’re here to help you every step of the way—because buying a home should feel exciting, not overwhelming.

? Let’s talk about your goals and make your dream home a reality.

#BetterCallJamohl | JD PDX Real Estate | Premiere Property Group, LLC | 503.545.4945

#Homebuyer #JDPDXRealEstate #homeowner #househunting #realestate #realtor #realestateagent #investment #finances #newhome #dreamhome

Join The Discussion