Extra Extra Are Those Home Improvements Deductible?

Home Improvements Deductible

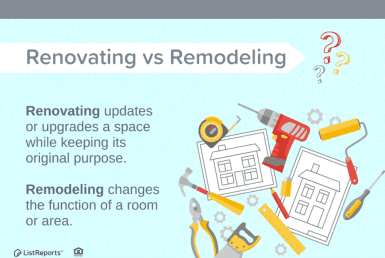

Are those home improvements deductible? Yes, but only after you have sold your home. According to the IRS, home improvements add to the basis, or value, of your home. A tax-acceptable improvement is defined as one that adds value to your home, “considerably” prolongs your home’s useful life, or adapts your house to new uses. Examples include installing new plumbing or wiring or adding a bathroom. If the work done on the home is purely for maintenance, the cost cannot be deducted and generally cannot be added to the basis, or value, of your home. However, repairs done as part of an extensive remodeling or restoration of your home are considered improvements and, therefore, pass the deductible test.

Join The Discussion